17 Jun 2015

Thailand’s Muslim-Friendly Destination Strategy Goes Well Beyond Just Tourism

Bangkok – When one of Southeast Asia’s largest Buddhist-majority countries launches a tourism outreach to attract Muslim visitors, it clearly has a much wider significance than just a travel industry development. Although the primary goal of the tourism authorities is to boost visitor arrivals, expenditure and average length of stay, the Thai government is also mindful of the broader goal to build inclusive societies, prevent religious and ethnic conflict, and contribute to the third and, arguably, the most important pillar of ASEAN integration, the Socio-Cultural Blueprint.

=========== |

========== |

========== |

========== |

========== |

TAT Acting Governor Mrs Juthaporn Rerngronasa |

House-full at the table-top business networking session. |

There was no shortage of interest in attracting business from the invited buyers of the Islamic world. |

The strategy to position Thailand as a Muslim-friendly destination was unveiled on June 5 at the Thailand Travel Mart Plus, the country’s most important annual B2B trade show. A total of 113 tour operators and media from Iran, Egypt, Kuwait, Tunisia, Indonesia, Malaysia, Brunei, Oman, the UAE, Turkey, India and Singapore were invited to attend a day-long launch event. They were taken on tours in and around Bangkok as well as other provincial destinations. The TAT also produced a number of collateral publications highlighting Halal restaurants in Thailand and Islamic attractions in the Southern Provinces. On June 22, it will launch a new mobile app to be used as an offline/online guidebook for Muslim visitors.

For the Tourism Authority of Thailand, directing its attentions at the Islamic market is a continuation of what it does best – monitor global travel trends, identify new and emerging markets, and then connect consumers, buyers and media in those markets with Thailand’s diverse range of products and services. Over the years, it has followed that simple strategy well to tap the voluminous European, Japanese, Korean, Russian, Chinese and Malaysian source markets.

Huge potential

The TAT has spotted the potential identified in the market research and rankings reports issued by DinarStandard and CrescentRating. Of the 1.6 billion Muslims globally, the vast majority live in Asia. The 2015 Global Muslim Travel Index 2015 (GMTI 2015) by MasterCard & CrescentRating estimates the Muslim travel market in 2014 as being worth $145 billion, with 108 million Muslim travellers representing 10% of the entire travel economy. That is projected to grow to 150 million visitors by 2020 with an expenditure projected to grow to $200 billion.

In her speech to the invited tour operators and media at the TTM+, Mrs. Juthaporn Rerngronasa, Acting Governor, TAT, referred to the new strategy as “a very special and historic moment for us.” She said Thailand has the required range of products and services for Muslim travellers. “We are already seeing many of our shopping complexes providing facilities for Muslim prayers. Halal food is also becoming commonplace. We are also seeing increasing investor interest in developing halal tourism hotels. All this is good for us because it will create jobs for our emerging younger generation and promote national inclusiveness and integration.”

Prof. Dr. Pakorn Priyakorn, President of the Foundation of Islamic Centre of Thailand, said in his presentation, “Historically and culturally Muslims have been an integral part of Thailand for centuries. Islam is not only the second largest religion in the kingdom but also enjoys royal and official patronage. The Thai law provides for freedom of religion, and the Royal Thai Government (RTG) generally respects this right in practice.” He said the Thai population of 67 million comprises 5.8 million (8.6%) Muslims as of 2013. There are 3,600 mosques nationwide, including 180 in Bangkok. Muslims enjoy full state support and free to teach and observe their religion according to their own tenets.

Dr Pakorn, who is also a Director, Halal Standard Institute of Thailand (HSIT), noted that Thailand’s other mainstream economic sector, agriculture, would also benefit from the TAT strategy. Thailand is already one of the world’s biggest food exporters and one of the five biggest exporters of non-pork, non-alcoholic foods to the Organisation of Islamic Cooperation countries. Halal certification in Thailand was initiated in 1969. As of 2014, the HSIT has halal certified 4,000 factories covering 120,000 products (10% for export).

Halal Strategy

Indeed, on June 2, 2015, just three days prior to the TAT event, the Thai cabinet approved the Halal Development and Promotion Strategy for 2016-2020. The objective is to promote Thailand as a key manufacturing and export base for halal products and services, increase the country’s revenue, build awareness and trust in Thai halal products. The accompanying Action Plan is a three-pronged effort involving the Thai public and private sectors and various Islamic institutions in Thailand.

Although the Global Muslim Travel Index 2015 ranks Malaysia and Indonesia as the top destinations for Muslim travellers amongst Muslim-majority countries, Thailand is ranked second amongst the Muslim-minority countries, after Singapore. TAT officials are making no secret of their desire to gain top spot within a few years.

Presently, Thailand gets an estimated three million Muslim visitors a year. Of this, about 75% would be from Indonesia and Malaysia. There is strong potential to attract more Muslim visitors from India, Bangladesh and Pakistan, all of which are within four-to-five hours flying time of Thailand. The next generation of Muslim visitors will flow from Central Asian Republics, North Africa and the large ethnic Muslim populations in Europe, South Africa and elsewhere.

Muslim visitors are both a quality and quantity customer segment. Visitors from the Gulf countries have a high average length of stay and daily expenditure. For example, in 2013, visitors from the UAE had an ALS of 10.6 days, while Thailand’s overall average was 9.8 days. The average daily expenditure of UAE visitors was more than US$195, while the overall Thailand average was US$150.

Aviation advantage

TAT officials note that Thailand gets more direct flights from Islamic countries than any of its ASEAN neighbours. Emirates Airlines flies 6 times a day from Dubai to Bangkok, Etihad Airways 3 times a day from Abu Dhabi, Qatar Airways 4 times a day from Doha and Oman Air twice a day from Muscat. On a weekly basis, there are 11 flights from Istanbul, daily flights from Amman, six flights from Almaty, Kuwait and Bahrain, five flights from Cairo and two weekly flights from Tashkent. In addition, Etihad Airways, Emirates Airlines, and Qatar Airways also have direct flights to Phuket, now rapidly emerging as Thailand’s second most important aviation gateway.

Citizens of the following OIC countries can get 15- or 30-day visa-free access to Thailand: Oman, Qatar, UAE, Malaysia, Indonesia, Brunei, Saudi Arabia, Maldives, Turkey, Uzbekistan and Kazakhstan. At the Arabian Travel Market in May 2015, Minister of Tourism & Sports Mrs Kobkarn Wattanavrangkul said that nationals of GCC countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE), can get a 90-day visa-free stay for medical treatment. The regulation also allows a patient to be accompanied by up three GCC nationals for the same 90-day period without visa. Further details are available on the website of the Royal Thai Embassy and Royal Thai Consulate in all GCC countries.

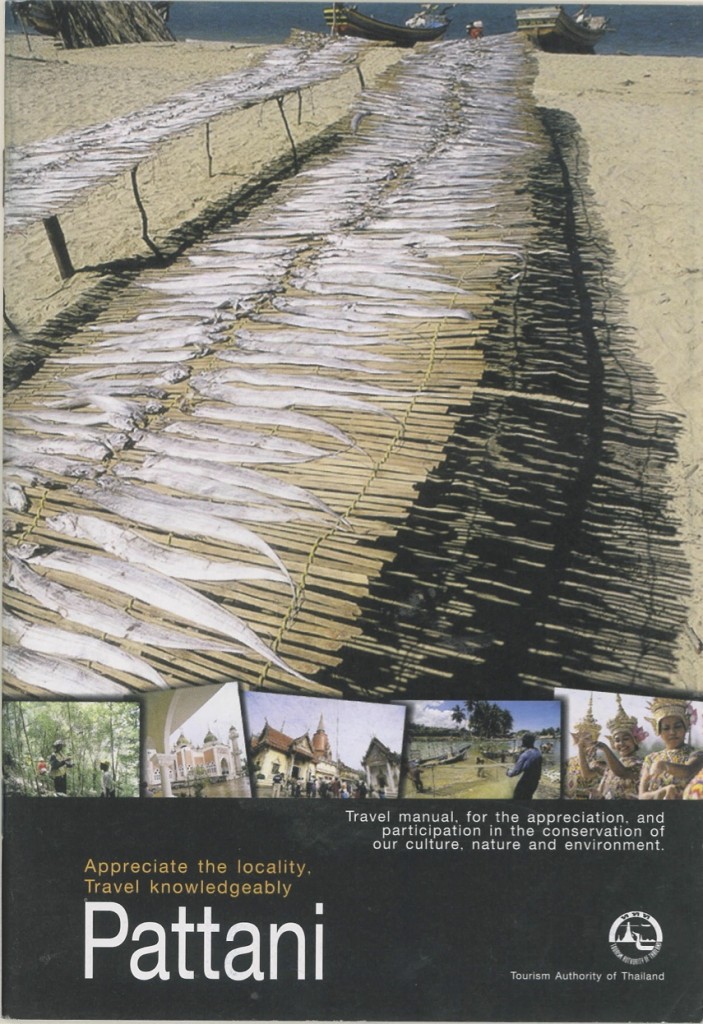

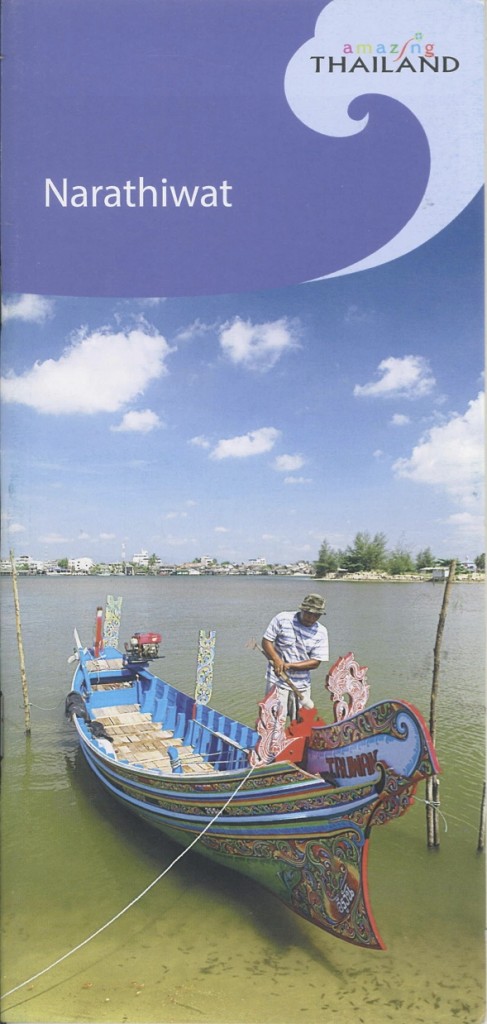

The Thai private sector responded well to the TAT’s Muslim-friendly initiative. A total of 92 Thai exhibitors (see full list below) turned up at the table-top session organised at the TTM+ to meet with the invited buyers. Flown in by Thai Airways International, Emirates, Etihad, Oman Air and Mahan Air, many of the buyers were visiting Thailand for the first time. The invitees also met with other tourism operators exhibiting at the TTM+. TAT has produced a number of guidebooks and brochures to help Muslim visitors such as “Halal Check-in Thailand”, which contains a list of halal certified restaurants as well as brochures on tourist spots in the southern provinces of Yala, Narathiwat and Pattani.

Mr. Siripakorn Cheawsamoot, Executive Director of Information Technology Office, TAT, introduced the mobile app designed for Muslim visitors to be launched June 22. This will make it easier for them to find Muslim-friendly products, services and facilities nationwide. Designed for IOS and Android, it will be an online/offline guidebook to more than 500 sites and locations of potential interest to Muslim visitors, including mosques, halal restaurants and hotels, shopping centres with prayer rooms, and other facilities around the country. A map will also be incorporated to help navigation. Initially to be in Thai and English, it will be expanded to Arabic and Bahasa Indonesia later.

Broader development strategies

The Muslim-friendly outreach fits well within Thailand’s national and regional development strategies. A primary beneficiary will be South Thailand, home to 63% of the Thai-Muslim population. A low-grade insurgency has held back economic progress. As young Muslims in some of the restive provinces find it difficult to get jobs, many have shifted to the neighbouring provinces of Phuket, Krabi and Phang-nga, where tourism is booming. Today, Thai Muslims make up about 30% of Phuket’s population. The provincial authorities are gearing up to position it as a Halal food centre and show the island’s readiness in catering to the special dietary needs of Muslim visitors. TAT also forecasts that Phuket and Thailand’s Andaman coast will become one of the top destinations for Arab visitors.

Because southern Thailand shares a border with northern Malaysia, the prospects for promoting cross-border tourism are obvious. The invited participants to the TAT forum also discussed opportunities for Thai-Malaysian tourism and were introduced to routes linking Sungai Kolok-Kelantan. They were also taken on fam trips to survey tourism products and services for Muslim tourists in Pattaya, Hua Hin and Phuket. The trip included special spots of potential interest to the high-end and intermediate markets, family and women groups.

In her speech, the TAT’s Mrs Juthaporn said, “A new borderless ASEAN will emerge from 2016 onwards, after which we project a huge increase in Muslim visitors from our ASEAN neighbours to the South, specifically Indonesia, Malaysia and Brunei Darussalam.” Hence, positioning Thailand as a Muslim-friendly destination will make a major contribution to strengthening the Socio-Cultural Blueprint of ASEAN Integration and boost intra-regional travel.

To download the presentations during Thailand’s Muslim-Friendly Destination forum, please click the following links:

1: Thailand Muslim Friendly Destination by Dr. Pakorn Priyakorn

2: Readiness of Thailand to Welcome Muslim Visitors by Mr. Imtiaz Muqbil

3: Halal Tourism by Mr. Siripakorn Cheawsamoot

List of Thai Exhibitors at Table Top Sale

Tour operators

1. TravelBullz Ltd.

2. Royal Thai Travel & Trading

3. Asia Channel Holidays Co., Ltd.

4. AMI Thai Ticket and Travel Co., Ltd.

5. Topaz Travel

6. World Travel Service Ltd

7. World Travel Service Ltd

8. Ling Ping Tour Co.,Ltd

9. Samphran Elephant Ground

10. Go Vacation Thailand.

11. Thai Vision Holidays Co.,Ltd

Entertainment

1. Nanta Show

2. Siam Ocean World

3. Tiffany’s Show Pattaya

4. The Platinum Fashion Mall

5. Pattaya Floating Market

6. Alcazar’s Show Pattaya

7. Nongnooch Village

8. King Power International

9. Central Department Store

10. Siam Niramit

11. The Mall Group

12. Thai Show 2013 Co., Ltd. (Muay Thai live)

13. Flying Media Co.,Ltd Balloon Adventure Thailand

14. Orawana International

15. RSU Healthcare Co., Ltd.

Hotels & Resorts

1. Almeroz Hotel

2. A-ONE Hotel, Bangkok-Pattaya

3. Centara Hotels & Resorts

4. CentrePoint Hotel Sukhumvit 10

5. Duangjitt Resort & Spa

6. Grande Centre Point Hotel Ratchadamri

7. Maikhao Dream Hotels & Resorts

8. Sri Panwa Phuket

9. Aonang Princeville Resort & Spa

10. Jasmine City Group Hotel, Bangkok

11. Novotel Bangkok Platinum Pratunam

12. Novotel Phuket Vintage Park Resort

13. Royal Cliff Hotels Group

14. Patong Beach Hotel and Baan Samui Resort

15. The Sukosol Bangkok

16. Aetas Hotel&Residence

17. Zeavola Resort Phi Phi Island

18. Ramada D’MA Bangkok

19. Nouvo City Hotel, Bangkok

20. Plaza Athenee Bangkok, A Royal Meridien Hotel & Resort

21. St.Regis Bangkok

22. Cham’s House, Koh Kood

23. Koh Yao Yai Village

24. The Aquamarine Resort&Villa

25. The Village Coconut Island Beach Resort

26. Mövenpick Resort & Spa Karon Beach Phuket

27. Alpina Phuket Nalina Resort & Spa

28. La Flora Patong

29. Le Coral Hideaway Beyond Phuket, Natai Beach

30. Rama Gardens Hotel, Bangkok

31. The Royal Paradise Hotel & Spa, Patong Beach Phuket.

32. Duangtawan Hotel, Chiang Mai

33. Sunda Resort

34. Aonang Silver Orchid Resort

35. Ramada Plaza Bangkok Menam Riverside

36. Sofitel Bangkok Sukhumvit

Others

1. Rajdamnern Stadium

2. Siam City Insurance

3. Rarin Jinda Wellness Spa Resort

4. The Oasis Spa

5. Bangkok Hospital Pattaya

6. Apogayaveo Thai Traditional Medicine Clinic

7. Sankampaeng Hotspring

8. Paolo Hospital

9. Royal Park Rajipruek

10. Dermaster