25 Sep, 2020

Survey finds Americans are prioritizing saving during Covid-19 outbreak

“With today’s economic uncertainty, many people have taken steps to adjust their financial habits to save more and better prepare for the unexpected.” This is probably a worldwide trend, and will put another damper on discretionary spending, such as on travel.

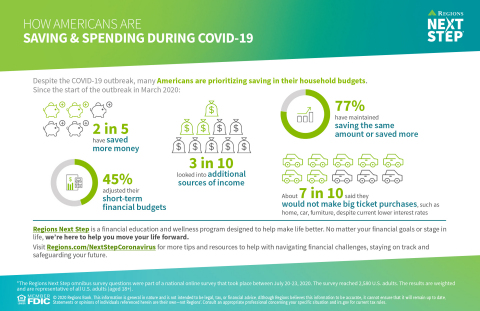

BIRMINGHAM, Ala., 21 September 2020, BUSINESS WIRE – The latest survey from Regions Next Step, Regions Bank’s financial education program, finds that the majority of Americans surveyed (77%) have maintained saving the same amount or saved more since the start of the COVID-19 outbreak in March 2020. Of these respondents, 2 in 5 (39%) say they have saved more money, with 1 in 10 saying they have saved a “significant amount” more.

The latest survey from Regions Next Step, Regions Bank’s financial education program, finds Americans are prioritizing saving during the COVID-19 outbreak. For information on a few steps to take to build savings during this time, visit Regions.com/NextStepCoronavirus. (Graphic: Business Wire)

Overall findings of the survey, conducted in July, indicate Americans are prioritizing saving in their household budgets. Other key findings include:

- 45% of respondents say they have adjusted their short-term financial budgets.

- 33% of those that have saved more adjusted their budget to do so.

- One out of 5 (19%) Americans say that they have made (or are making) investments to create a better work-from-home environment. Of those that saved, nearly 30% made or are making these investments.

- About 7 in 10 Americans said they would not be making big-ticket item purchases, such as a home, furniture, cars or electronics, despite current lower interest rates.

The findings of this survey come on the heels of an April survey from Regions Next Step that found having a formal financial budget contributes to feeling more financially fit, which may reduce stress and increase confidence in the ability to withstand a fiscal emergency.

“With today’s economic uncertainty, many people have taken steps to adjust their financial habits to save more and better prepare for the unexpected,” said Joye Hehn, Community Financial Education Manager for Regions. “We at Regions want to encourage people to build on that positive momentum and are providing financial planning tools and resources to help.”

The COVID-19 outbreak has increased awareness of the importance of having access to savings. Here are a few steps people can take when building their savings during this time:

- Set or revisit goals: Prior to planning or adjusting plans, set or reevaluate long- and short-term financial goals, then evaluate which are most important right now. Use this financial goals worksheet to create targets and rework budgets as needed.

- Build an emergency fund: When the economy is uncertain, reprioritizing savings goals may be needed, along with a focus on building an emergency fund. As a general rule, try to have three to six months of expenses in an easy-to-access savings account. Listen to this podcast for guidance on savings strategies to build this fund and prepare financially for the unexpected.

- Consider debt reduction vs. saving: Many may be wondering whether to pay down debt or save funds for a rainy day. It’s a good idea to consider how secure your finances are before deciding how to prioritize. Consider these factors when evaluating options.

- Cut back on unnecessary expenses: When money is tight, take steps to tighten the financial belt. Review receipts and the previous months’ bills, then cut expenses to reflect a practical budget. For example, cancel subscriptions that are rarely used or cut back on dining out, then reallocate those funds to savings.

For more advice on adjusting financial game plans for today’s challenging economic scenario, watch the on-demand webinar, Making a Money Game Plan for Tough Times, featuring Eric Smith, The Financial Literacy Coach.

Regions continues its commitment to providing financial education and guidance to customers, associates and people in the communities it serves during the COVID-19 outbreak and beyond. Visit Regions.com/

The omnibus survey questions were part of a national online survey that took place between July 20-23, 2020. The survey reached 2,580 U.S. adults. The results are weighted and are representative of all U.S. adults (aged 18+).

Liked this article? Share it!