31 Jan, 2024

Saudi Arabia in big demand at Thai travel show as outbound rebounds

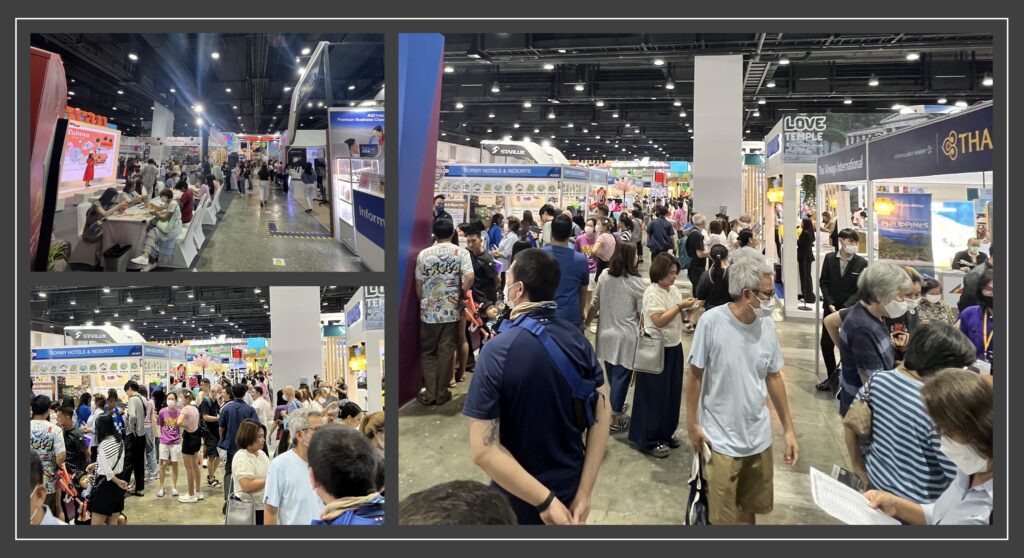

Bangkok – Saudi Tourism made its second appearance at the 29th Thailand International Travel Fair [TITF 2024], the annual event organised by the Thai Travel Agents Association (TTAA), which groups the country’s outbound travel agents and tour operators. It was one of the highlights of the 24-28 January event at the Queen Sirikit National Convention Centre. A one-day B2B show on 24 January was attended by 231 sellers and 298 Thai buyers, followed by a four-day consumer show between 25-28 January with more than 200 exhibitors occupying 500+ booths.

Alongside inbound tourism, Thai outbound travel is also recovering, thanks to a robust middle class with discretionary spending power, targetted marketing by airlines, hotels and credit-card companies, the impact of social media and technology, and upgraded transportation linkages such as airports and rail terminals. In pre-Covid 2019, outbound travel crossed the 10-million mark, not including the several million expatriates living in Thailand. Figures for 2023 have not yet been released but, judging from the crowds at the TITF, they are expected to be quite positive.

This year marks the TTAA’s 40th anniversary. It was set up in 1984 primarily to defend the interests of mom-and-pop ticketing agents, bucket-shops and a handful of tours operators against the domination of the airlines, specifically the International Air Transport Association. Today the TTAA has matured considerably but is facing new challenges such as technology, visas, financing schemes, etc. Fortunately for TTAA members, most Thais still prefer to use travel agents to make their foreign bookings, and guided group tours still dominate the recreational travel sector.

The TTAA had projected attendance of 200,000 this year, but judging from the attendance I personally saw, I believe it would be much higher. This year’s TTAA-TITF indicated several new trends but also raised a few issues.

1. Saudi Arabia

Exactly two years after the diplomatic patch up between Thailand and Saudi Arabia after a 32-year rupture, the peace dividend delivered yet again with the presence by Saudi Tourism at both the B2B table-top session and the consumer show. Staff members based at the regional office in Kuala Lumpur manned the consumer-show booth to promote the online visa facilities and four-day visa-free stopover programmes. The Saudis also had a QR code ready to monitor feedback and get some instant market research.

At the moment most of the travel to Saudi Arabia comprises of Thai Muslims going on Umra trips, business trips or Thais taking up jobs. But leisure tourism is growing, especially amongst curious, upmarket Thais. Saudi Tourism certainly will certainly need to expand its future marketing and brand building in Thailand.

However, the two kingdoms are missing out on the real opportunity.

In their publicity material, both are exploiting the commercial and economic benefits of the diplomatic detente, with no attempt to frame it within the context of its main objective, viz., to build peace between the peoples of two of the world’s leading Buddhist and Islamic kingdoms.

In a world overwhelmed by conflict, chaos and confusion, the Saudi-Thai patch-up stands out as a beacon of hope and an example of building peace, friendship and fraternity. To omit that and merely focus on the commercial and economic benefits trivialises the significance of the landmark peace deal.

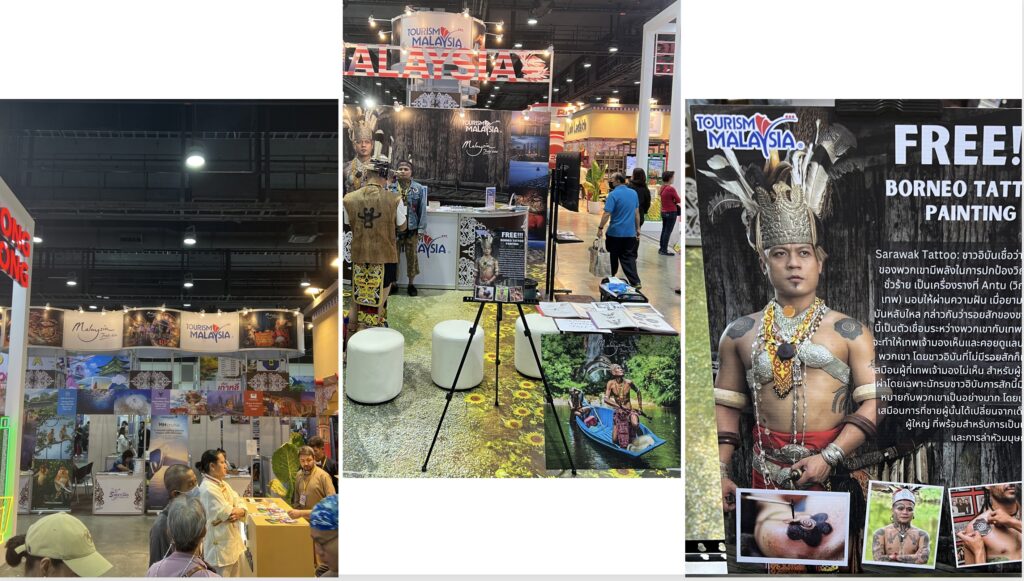

2. Malaysia

Malaysia had a large presence at both the B2B and consumer show. A dash of culture and music always helps attract consumers. Especially prominent was a separate pavilion by the state of Perak which shares an overland border with Thailand, via the Betong checkpoint. The state had a polished set of collaterals including a Thai-language brochure and a mosque tours guidebook. Promoting cross-border tourism is one of the main goals of both the Malaysian and Thai governments and an integral part of other sub-regional development agendas such as the Indonesia-Malaysia-Thailand Growth Triangle.

3. Japan

The Japanese presence was less than in previous years. Thai travel to Japan has boomed since the 2013 removal of the visa requirement for Thais (https://www.travel-impact-newswire.com/2014/02/visa-free-japan-dominates-thailand-travel-fair-2014/). Japanese exhibitors rushed to participate in the TITF. But the number of exhibitors has dwindled as the Thais become more familiar with the Japanese destinations and Japanese exhibitors shift to social media. This year, there were about 30 Japanese companies at the table-top B2B, half the Chinese contingent.

4. China

Chinese products dominated the B2B with just under 60 companies represented, the largest representation by a single country. This will grow in future, especially in the aftermath of the new visa-free travel arrangement set to take effect from 1 March. It will also play a major role in helping fill up airline capacity, boost route profitability and attract more flights to Thailand, especially between the secondary cities.

5 ASEAN

The ASEAN presence remains negligible, testifying to the failure of promoting ASEAN as a single destination. Only the Philippines and Malaysia had high-profile pavilions. Vietnam was being promoted by a private tour operator. Singapore and Indonesia were represented only at the B2B. Laos, in spite of marking Visit Laos Year 2024, was not present. Over the years, ASEAN tourism ministers have signed several agreements to promote intra-regional tourism and ASEAN as a single destination. However, the ASEAN presence at travel trade shows has failed to deliver on that objective.

6. Emerging destinations

These included Pakistan, Uzbekistan, Georgia, Leh/Ladakh and Murmansk on the east coast of Russia. If these destinations become more popular, direct scheduled flight frequencies will grow, or new routes will be opened, both of which in turn will benefit inbound travel to Thailand, too. Macao and Taiwan are also doing well, thanks to visa-free access for Thais.

7. Airline and cruise presence

A number of airlines such as Thai Airways, Eva Air and Cathay are regular exhibitors. Usually, the lineup is dominated by the low-cost airlines. This year, none of the mainstream low cost airlines such as Thai AirAsia, LionAir and VietJet, were present. On the other hand, cruises are becoming popular in line with the demographic ageing of the Thai population.

8. Corollary travel suppliers

Thai banks offer generous payment schemes. While these schemes speed up the decision-making, a deeper analysis is required of the travel-now pay-later schemes offered by all the banks to analyse their impact on the national debt burden, a serious economic problem in his own right. The wanderlust bug can bite ferociously, but once the fun is over, the bills still have to be paid.

At the same time, other suppliers such as baggage companies and SIM cards also do brisk business.

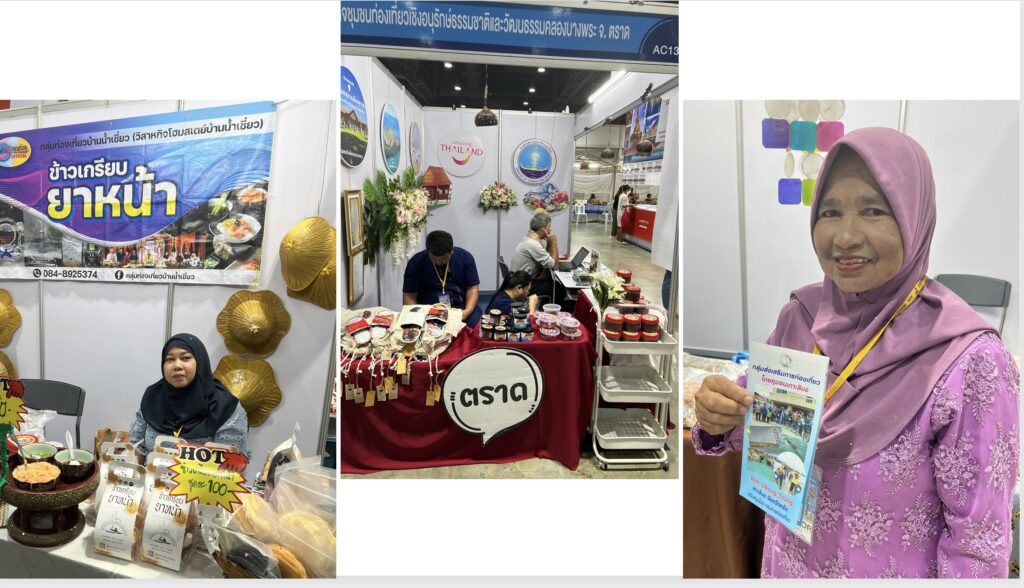

9. Small & medium sized, local community enterprises

Although the TITF is an outbound travel show, domestic travel companies also participate. A number of community based projects and small and medium size business enterprises did. Sadly all were buried at the back of the hall or relegated to the side, away from the main corridors. They also did not get much publicity in the handouts and collaterals. This flies in the face of the travel industry’s mantra about promoting grassroots, community-based tourism.

10. Deals Deals Deals

The TITF consumer show is largely all about discounts and deals. The prices on offer for the various destinations are on full display here.

Conclusion

The TITF holds considerable promise to become a major travel show, if a number of obvious weak points can be addressed.

This year, destinations such as the United States, Canada, Australia, New Zealand and the Latin American countries were conspicuous by their absence. They have participated in earlier years, especially the Latin American countries, many of whom give visa-free access to Thai citizens. The reason for this on-again, off-again presence is not clear, but worth further investigation.

Indeed, the TITF lacks a conference component with presentations on research and trends on Thai outbound travel. The TTAA’s website, newsletters, press releases and overall communications platforms are very weak in English. Potential exhibitors exploring the Thai market would fail to gain a comprehensive understanding of its importance and effectiveness.

Thailand currently has three big travel shows — the Thailand Travel Mart Plus organised by the Tourism Authority of Thailand, (the top inbound travel event) the Thai Tiew Thai travel show (for the domestic market) and the TITF. It may be worth exploring the feasibility of combining them all into one large travel trade show-cum-summit that can bring the entire world to Thailand and become a Travel & Tourism celebration in its own right.

Liked this article? Share it!