11 Feb, 2024

Thai travel industry urged to reduce usage of US$ for doing business

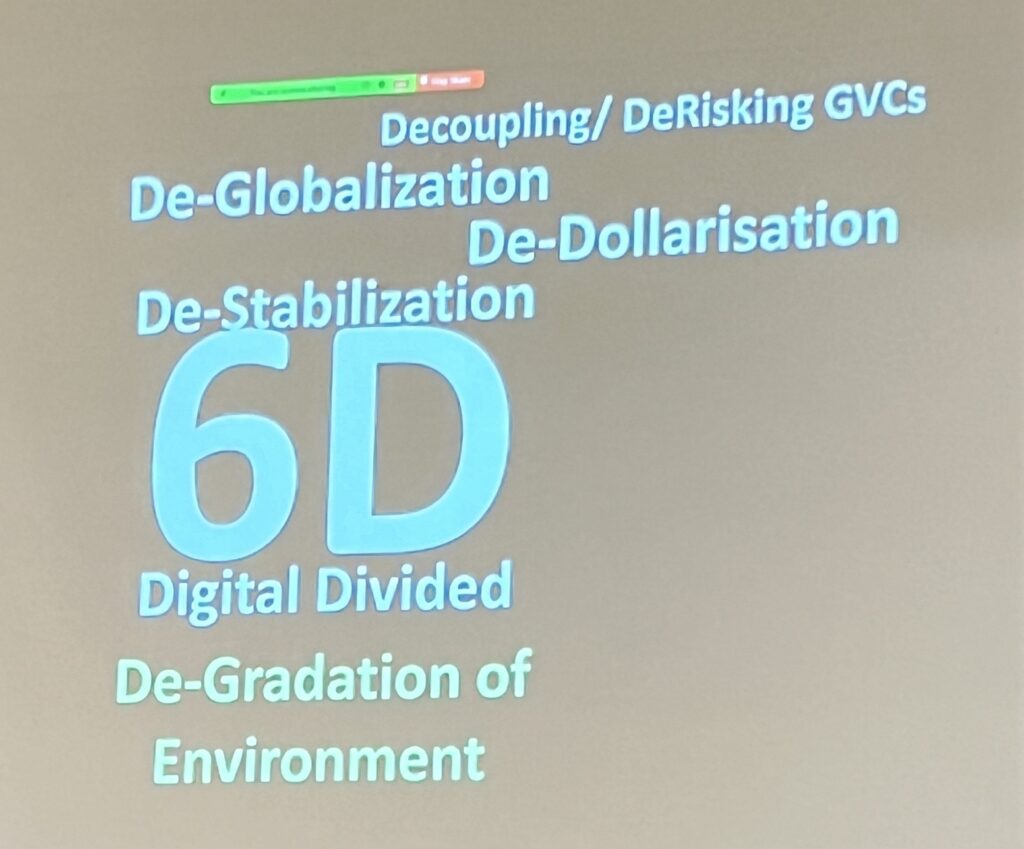

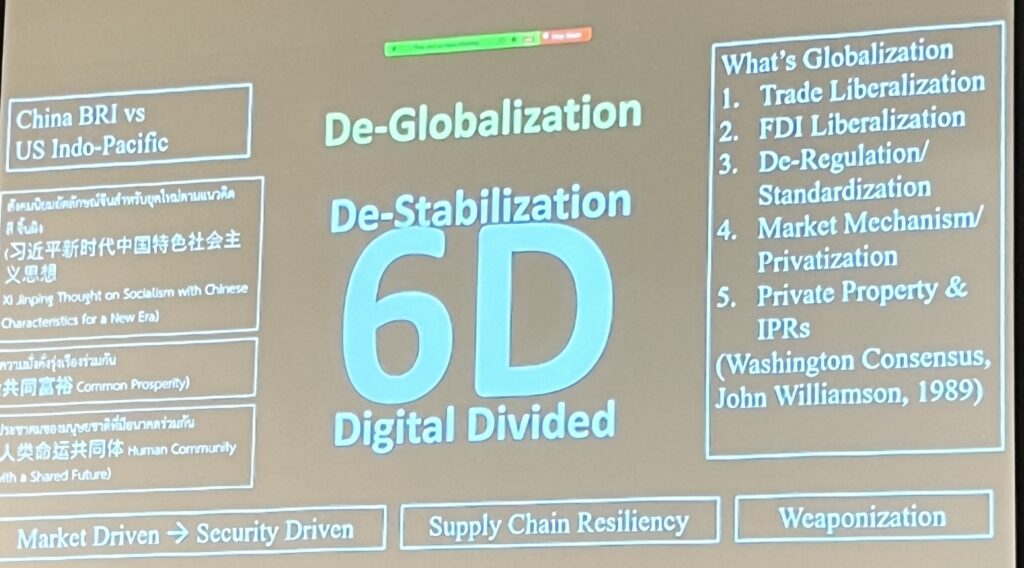

Bangkok – The Thai travel & tourism industry has been warned about using the US dollar for business transactions and urged to use the currencies of the countries with which they are doing business. In a landmark lecture at this year’s joint meeting of the Association of Thai Travel Agents and the Thai Hotels Association on 5 February, Professor Dr. Piti Srisangnam, head of the ASEAN Foundation, cited “De-Dollarisation” as one of “6D” trends that will shake up Travel & Tourism, the other five being Decoupling/ DeRisking of the global value chains, Deglobalization, Destabilization, the Digital Divide and Degradation of Environment.

The lecture is set to reset the content of industry discourse, in Thailand and beyond. For the first time, two leading Thai travel & tourism industry associations invited a professor to discuss the impact of geopolitical conflicts on their businesses, jettisoning the repetitively boring talks on post-Covid recovery, sustainability and technology. In a cogently argued lecture, Dr Piti challenged many of the sunny-side-up positions presented by corporate speakers at industry forums. Between the lines, he highlighted the problematic role of the United States in all the 6Ds, from wars and conflict to currency volatility, trade wars, technological disruption and environmental degradation.

A profile of the Australian-educated Dr Piti can be found here: https://www.aseanfoundation.org/dr_piti_srisangnam

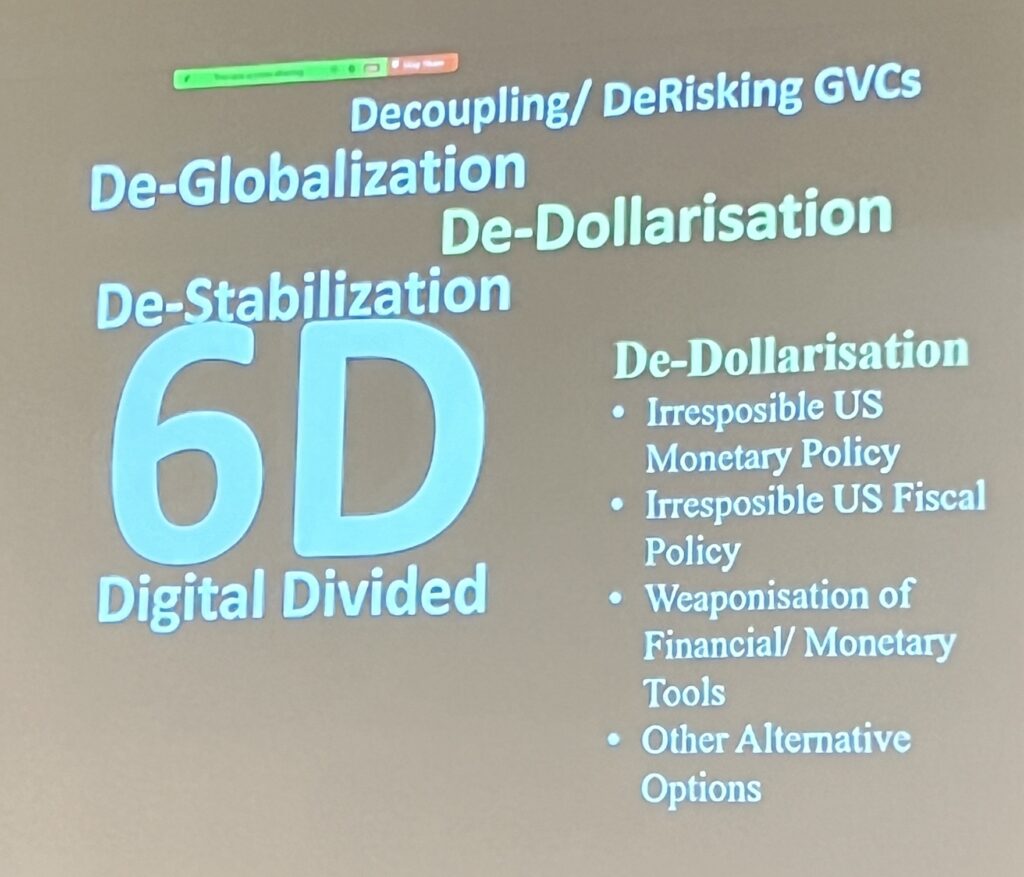

Of all the 6Ds, his most detailed views were on De-Dollarisation, which directly impacts on the bottom lines of every company.

Prof Piti outlined many reasons why countries and companies were shifting away from the US dollar. More than 50% of China’s international trade no longer uses the US dollar. China has also scaled back its US Treasury Bond holdings from over $1.3 trillion to $700 billion because of “irresponsible US Monetary and Fiscal policies.”

He cited the example of the US’s deployment of Quantitative Easing (QE) measures to recover from the Sub-Prime Economic Crisis (2006-2009), Global Financial Crisis (2009-2012), Covid Crisis (2020-2022), during which the US pumped US$9.4 trillion into the system. Because interest rates in America were very low at that time, money flowed out of the US to, amongst other countries, Thailand. This made the baht strong and affected Thai tourism and exports.

The US, too, felt the impact as the QE policies triggered inflation. That, in turn, led to higher interest rates. In 2022 until the beginning of 2023, interest rates were raised 11 times from 0.25% to 5.5%. Then, money began to flow back to America in huge amounts, and led to a depreciation of the baht.

“So, managing currency fluctuations like this, many countries are beginning to think about why they must rely on America.”

Citing another example of “irresponsible US fiscal policy,” Dr Piti noted that the US government alone is in debt of US$35-36 trillion while the country’s GDP is US$26 trillion. Just paying off the debt is costing the US $1 trillion per month.

“These are the games that America is playing. It is like taking the first credit card to buy something. When the credit limit is full, use a second credit card to pay off the debt on the first credit card. When the second credit card is full, ask the Congress to raise the ceiling on third credit cards to pay off the first and second credit card bills. Eventually, this will land up in bankruptcy court.”

He said today, the question is whether the US will ever go bankrupt. “In the past, people did not believe that America would get to that point because everyone uses the US dollar. But now China, which is the world’s number one factory and economy, has cut its use of the dollar in half.” He said countries like The Netherlands and the British once had currencies that were dominant. “Is anyone trading with these currencies now? Answer: Very few.” So, he said, the question is not if it will happen, but when.

Debunking the claim that the US dollar is a safe-haven currency, he explicitly warned the tour companies and hoteliers that they could unknowingly run afoul of US anti-money laundering and anti-terrorism laws.

After 2001, he said, the US amended its Currency Act to allow the US dollar to become a tool for exercising extraterritorial rights. He said if two countries are using their own currencies for trading, there is no problem, but if the US dollar is used for any trading with a country that may be facing sanctions, such as Iran, “America has the right to arrest us.” That is why when China exports goods to Iran, the billing is always in Yuan.

He recalled the case of the CFO of Huawei, the daughter of the company’s owner, who was arrested while in transit through Canada, because of just one instance of Huawei using US dollars to trade. Eventually, nothing was found against her, and she was released.

He asked the tour operators and hoteliers if they had ever read the fine print of the foreign exchange declaration forms that have to be used when remitting or receiving foreign exchange from abroad. These declarations have to be filed by the transacting banks for submission to the Bank of Thailand (Central Bank).

“Have you ever read the details in the declaration document?” Dr Piti asked. “It will include some items that are not issued by the Bank of Thailand. They are issued by the Federal Reserve. What does the Federal Reserve have to do with Thai banks? For this reason, many countries do not want to use the US dollar.”

He forecast more economic problems this year because the US is in an election year. This will require the US government to prop up the economy by using more stimulus measures which will only create more debt. That will only see a repetitition of the same scenario that he had cited earlier of low interest rates, higher debt, inflow-outflow of funds, inflation and currency fluctuations. “So what mechanisms will we have to prevent exchange rate risks? If your business does not do well because of poor sales, that’s one thing. But losing money because of exchange rate fluctuations, that’s painful.””

On De-Stabilization, Dr Piti noted the how the war in Ukraine has impacted on food and energy security, and was also impacting on tourism. For example, Russians are no longer going to Europe, and both Ukrainians and Russians are travelling to Thailand. While this is good, many are also becoming investors and buying up distressed property such as small 2/3-star accommodations which went bankrupt during Covid. In future, this will mean more competition for Thai-owned properties.

He forecast that the Middle East situation is likely to spread, depending on whether Iran gets directly involved. Thailand will also be affected by disturbances closer to home such as the situations in Myanmar and the South China Sea. All these problems are in some way interconnected, and will impact other areas such as energy, food, mining and oil, which in turn, will impact on travel & tourism.

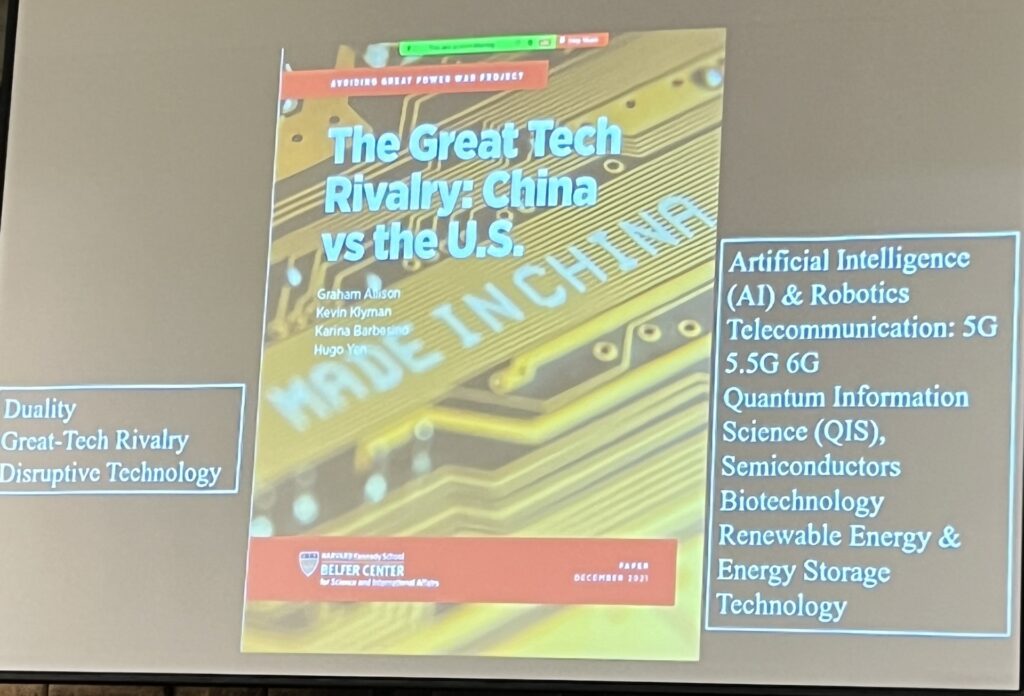

On the Digital Divide, Dr Piti said it was another battleground as the US and China compete for technological superiority, especially the mobile phone companies Apple and Huawei. While the technology that goes into the mobile phones will make travel more convenient, greater use of Artificial Intelligence (AI) will reduce the role of Tour Operators in planning trips and making bookings and reservations. That, plus the increased use of robotics will impact on job-creation in Travel and Tourism, especially among the rank-and-file.

A lot of the repetitive tasks can be performed by chatbots and robots. “Personnel management issues are one of the biggest headaches, especially in hotels. But robots work 7 days a week, 24 hours without a break. Most importantly, they don’t call in sick, don’t face marital problems, don’t take drugs and do not make customers feel annoyed. The question is, how do you adjust?”

All this technology will require infrastructure support, especially the use of 6G technology. And here’s another digital divide because countries such as Thailand are ahead while others such as Indonesia are behind. This will require constant investment in keeping the infrastructure upgraded.

The transition in energy will also be a challenge. As the world shifts to renewable sources of supply, new challenges emerge. For example, solar power can generate electricity but cannot store it, which makes it useless at night. Investment in energy storage is very high. When energy storage gains commercial ground, additional investment will be required in upgrading the infrastructure.

He also cited the wild price gyrations caused by seasonality or even temporary events like sports tournaments. Bars in England triple the price of beers during the broadcast of special football matches and go back to normal after its over. “Spatial Computing makes it very easy to change computer barcodes. So, for example, if you are walking in a shopping mall, and if it starts raining, the costs of rain-protection gear could be raised immediately.”

Dr Piti said industry pricing schemes were also plagued by confusion and could be inflationary. In the old days, the price of an air-ticket included everything — baggage, meals, etc. Now everything is on a user-pays basis. What will this mean in future? Will airlines charge for using bathrooms? Will hotels charge for drinking water, mattresses, and other things?

On enviromental degradation, Prof Piti said climate change is already impacting many aspect of life through natural disasters. This will only get worse as environmental issues become higher priority for travel industry and force a shift in product choices as well as customer preferences.

Conclusion

As I sat through the lecture, I was also observing the audience to gauge the reaction. It was clear from their expressions that they had never heard anything like this before. It was SWOT analysis with a difference — the Weaknesses and Threats were being flagged more than the Strengths and Opportunities. A refreshing semblance of balance has been injected into the discourse. As this was not one of those sponsored lectures, Dr Piti could speak freely and honestly, and did.

The question facing the travel & tourism sector now is: What do they do about it?

The best answer to that would be: Give Dr Piti and alternative thinkers more opportunities to present their perspectives. It’s stimulating and healthy. Travel & Tourism is being misguided and misled by preaching-to-the-converted “futurists, visionaries and thought-leaders”, mainly American corporations who pay for sponsorships and then get speaking slots to flog their products and policies.

But Dr Piti’s lecture clearly showed that there is a downside to blindly following the Pied Pipers of Hamelin.

Many of his warnings are quietly mulled behind the scenes at ASEAN forums and events. Due to diplomatic niceties, they cannot be mainstreamed.

That Rubicon has now been crossed.

Liked this article? Share it!