24 Dec, 2023

Thailand tourism enjoys robust rebound in 2023 but danger looms high for 2024

Bangkok — Since the end of the Covid-19 crisis in 2021, Thai tourism has enjoyed a robust rebound and is set to end 2023 just a little shy of 30 million visitors. While that may heighten optimism of hitting the pre-Covid total of 40 million in 2024, the Israel-Palestine war is already having an impact and could prove to be the biggest threat to a global tourism recovery in 2024.

Since taking office in Aug 2023, the Thai government’s rapid-fire measures to boost tourism from the core markets of India, Russia and China have produced results. The Malaysian market, mainly cross-border traffic in South Thailand, is firing on full cylinders. And the Saudi market has roared back following the bilateral diplomatic rapprochement last January 2022.

Between 1-21 December alone, arrivals at the three key aviation hubs, Suvarnabhumi and Don Mueang airports in Bangkok, and Phuket airport, had crossed 1.5 million. After accounting for arrivals from all air, land and sea points of entry over the entire month, there is an even chance that visitors will cross the three million mark in December.

Thailand has a perishable inventory of 787,000 accommodation units of all types (hotels, guest-houses, bungalows, resorts) nationwide, mostly in the beach resorts. These units, tabulated by the Ministry of Tourism and Sports as of early 2023, have to generate income every day. The need to fill the supply is a major driver of demand.

Here is an analysis of some of the key market trends so far:

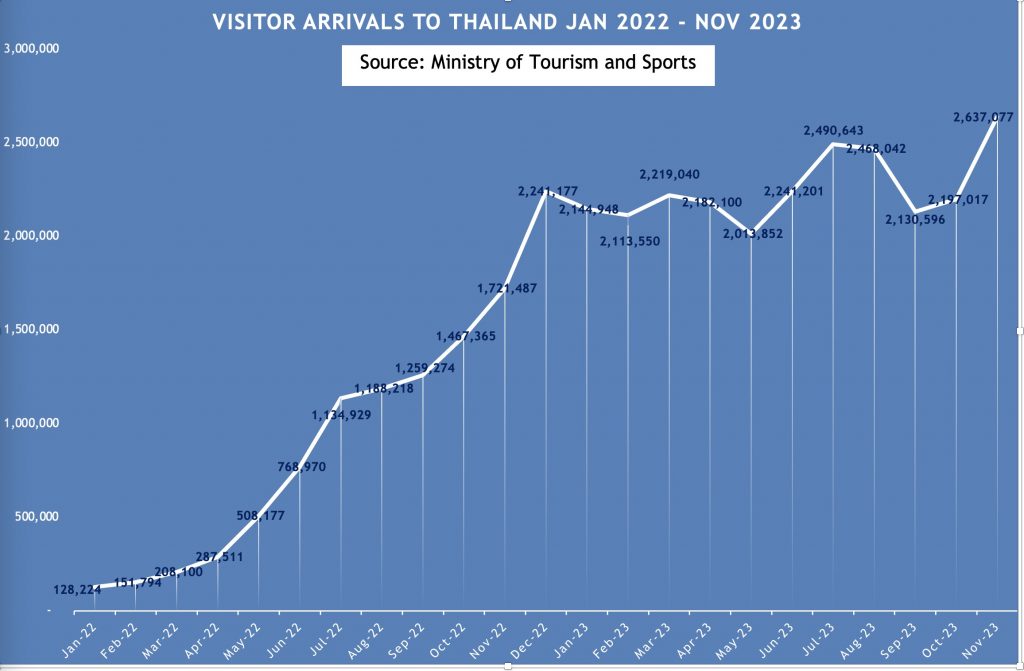

Total arrivals Jan 2022 – Nov 2023

As Covid-19 receded, and businesses reopened, travel was back in full swing. Arrivals have soared since Jan 2022, crossing two million in every month of 2023. The last quarter is seeing a noticeable uptick in response to the government’s tactical arrivals-boosting measures such as the visa-free and free-visa access for citizens of Russia, India, China, Kazakhstan, etc.

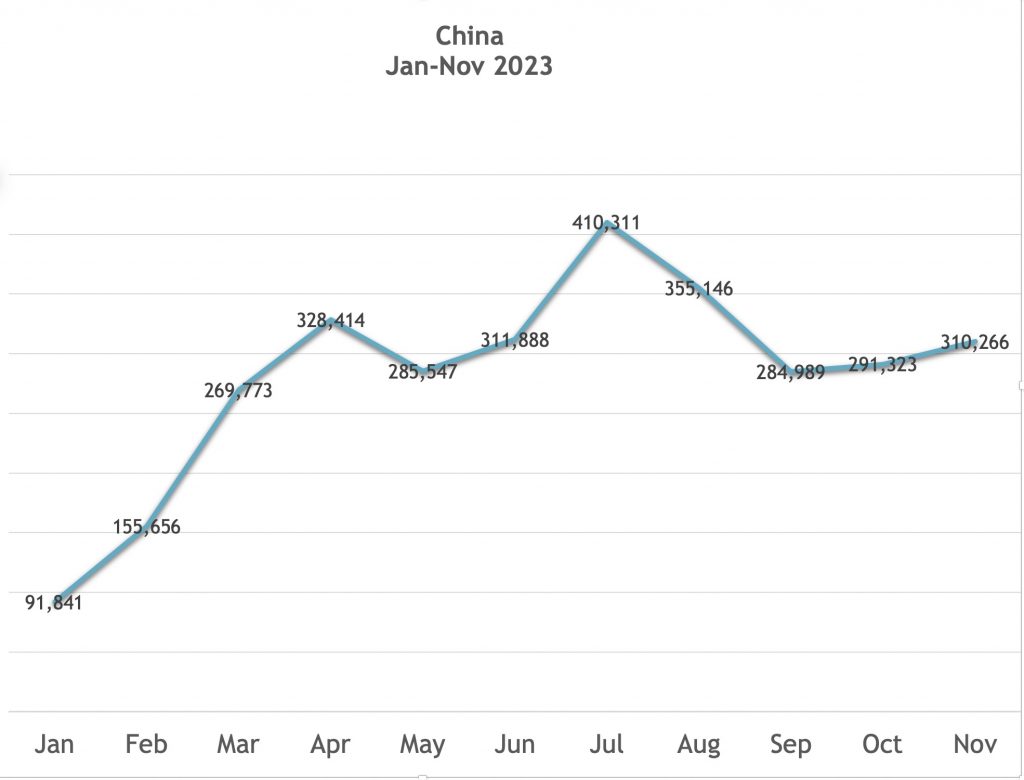

China

The early October 2023 shooting of Chinese tourists in a popular Bangkok shopping mall led to a sharp drop in daily arrivals for a few days. Rapid deployment of Thailand’s well-oiled tourism crisis management machinery mitigated the damage. The result was actually a small increase in arrivals from China in October. The overall number of Chinese visitors is still well below the 2019 level of 10 million, but the TAT’s six offices in China plus the private sector and airlines are going all out to bring them back. In the absence of any unforeseen events, that number may be reachable in 2024.

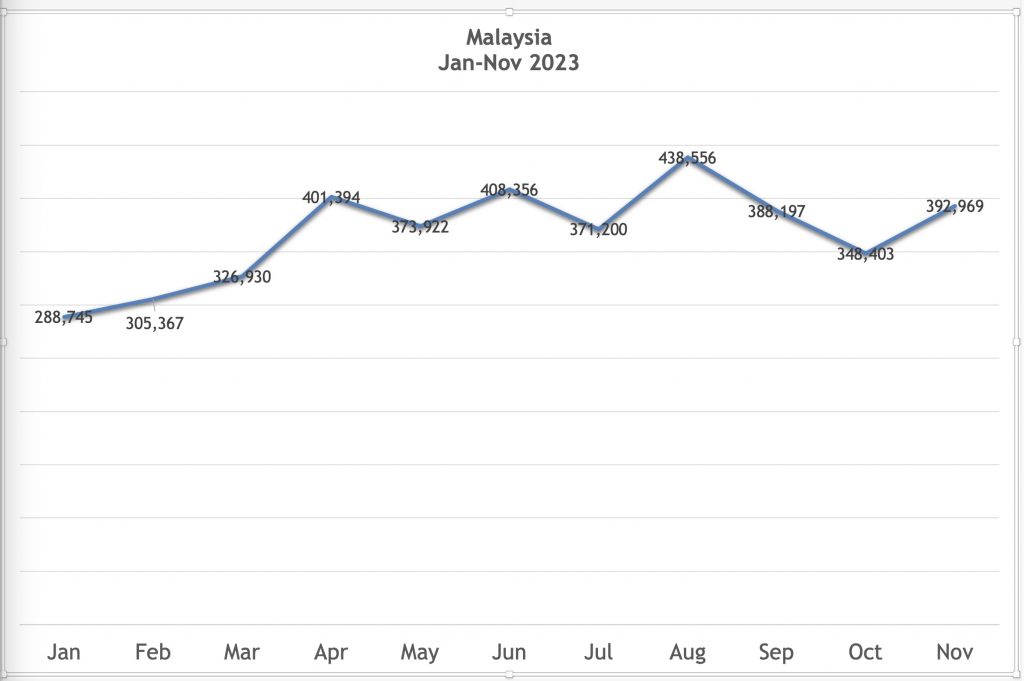

Malaysia

Cross-border traffic from Thailand’s neighbour to the South is again proving to be a life-saver. In addition to the overland arrivals, a number of low-cost airlines are operating between various points of Malaysia and Thailand. South Thailand is also attracting considerable investment in infrastructure and there is enormous potential for much more intra-regional tourism, especially including Singapore and Indonesia.

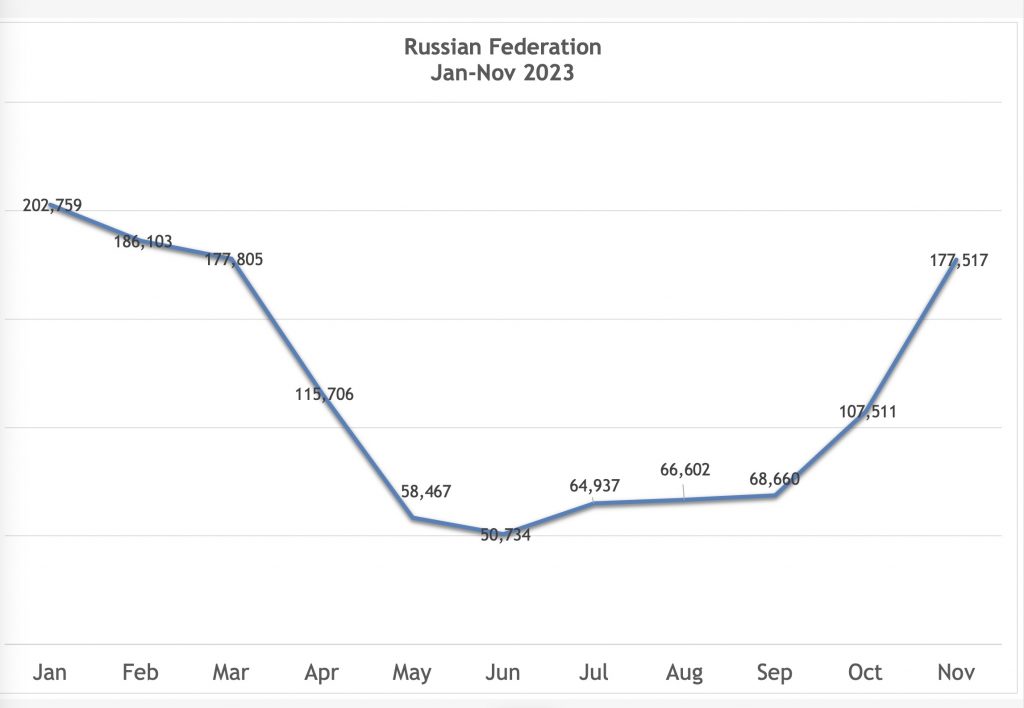

Russia

The war with Ukraine has seen well-heeled Russians exiting the country for the more comfortable locales of Phuket and Pattaya — a blessing for the massive real-estate inventory in both resorts.

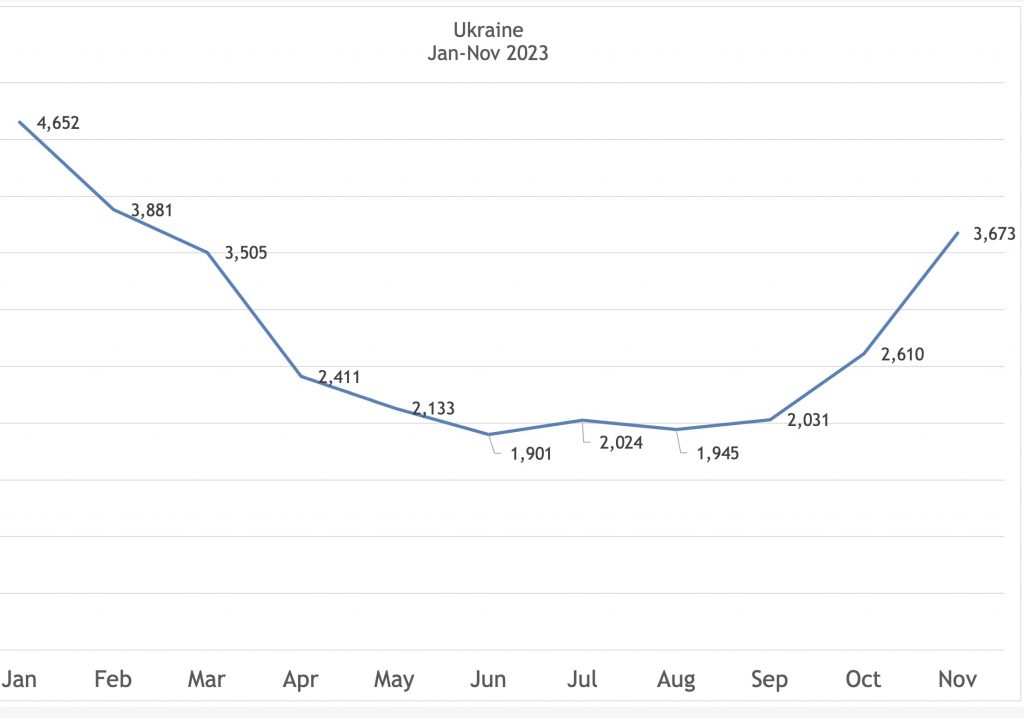

Ukraine

The Ukrainians are doing the same thing.

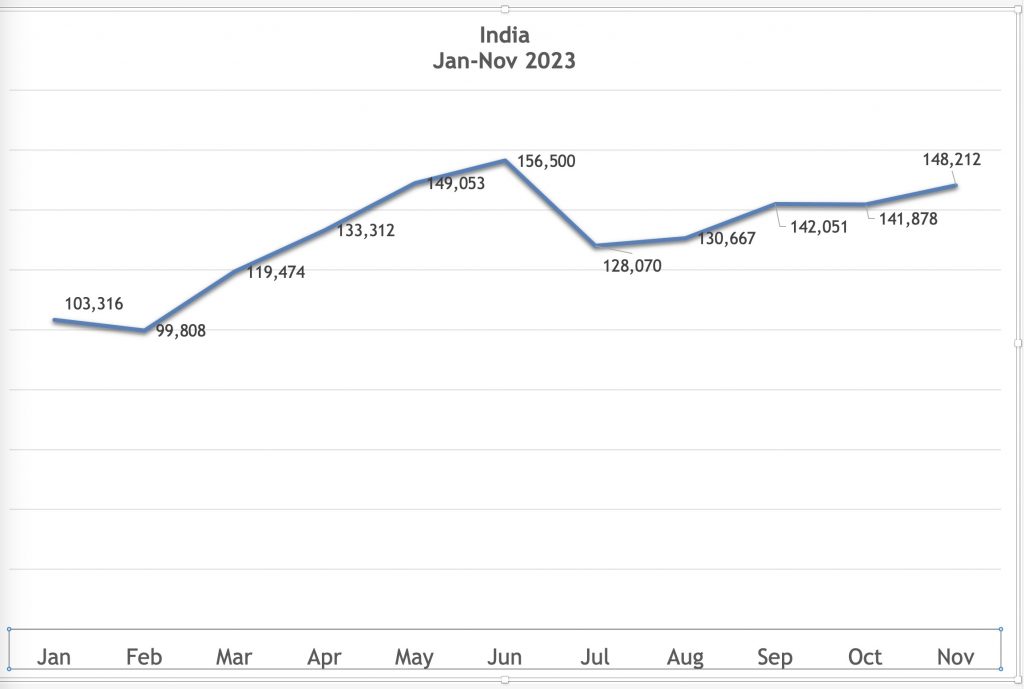

India

Another promising market delivering good results. Most of the key Indian metropolises with populations of 4+million are within four hours flying time of both Bangkok and Phuket. Thailand is a very high-demand destination in India, especially over the long-weekend holiday periods. Dozens of Indian restaurants have sprung up in Pattaya and other beach resorts. Next year will see nationwide Parliamentary elections in India. Given the politically polarised, communally divided, emotionally charged atmosphere, some travel disruptions are likely.

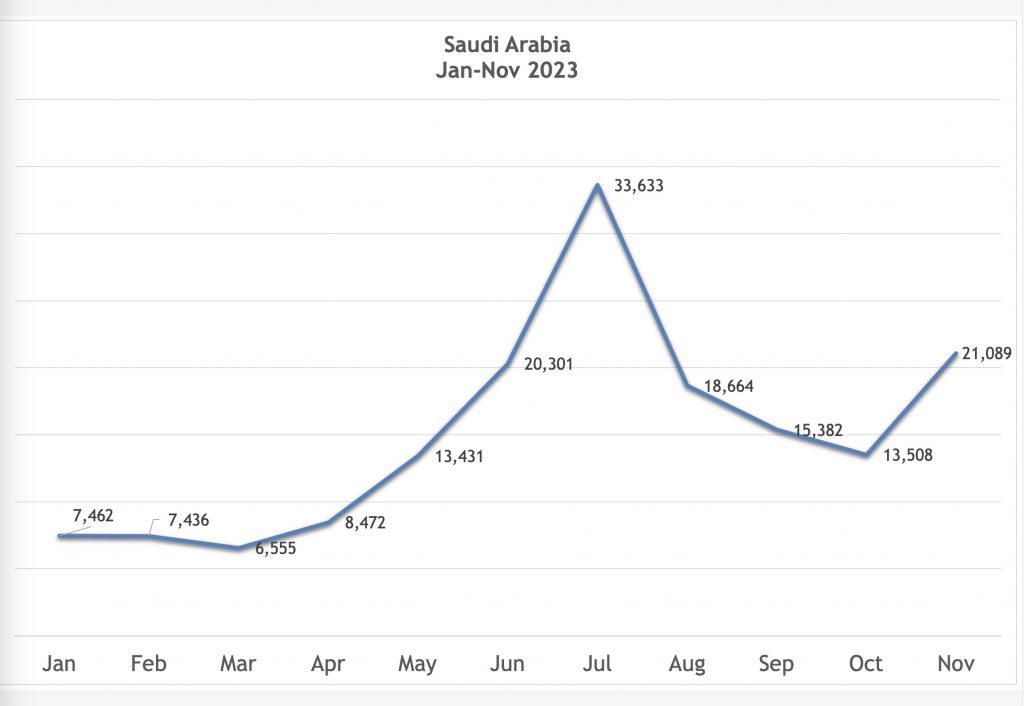

Saudi Arabia

A golden example of how tourism flourishes when countries make peace. In January 2022, Thailand and Saudi Arabia ended a 32-year diplomatic rift triggered by the 1989-1990 shootings of Saudi diplomats in Bangkok and a jewellery heist by a Thai worker from a member of the Saudi royal family. Relations are on an upswing across all fronts. Thailand will see voluminous Saudi travel for health and wellness, MICE events, business and leisure.

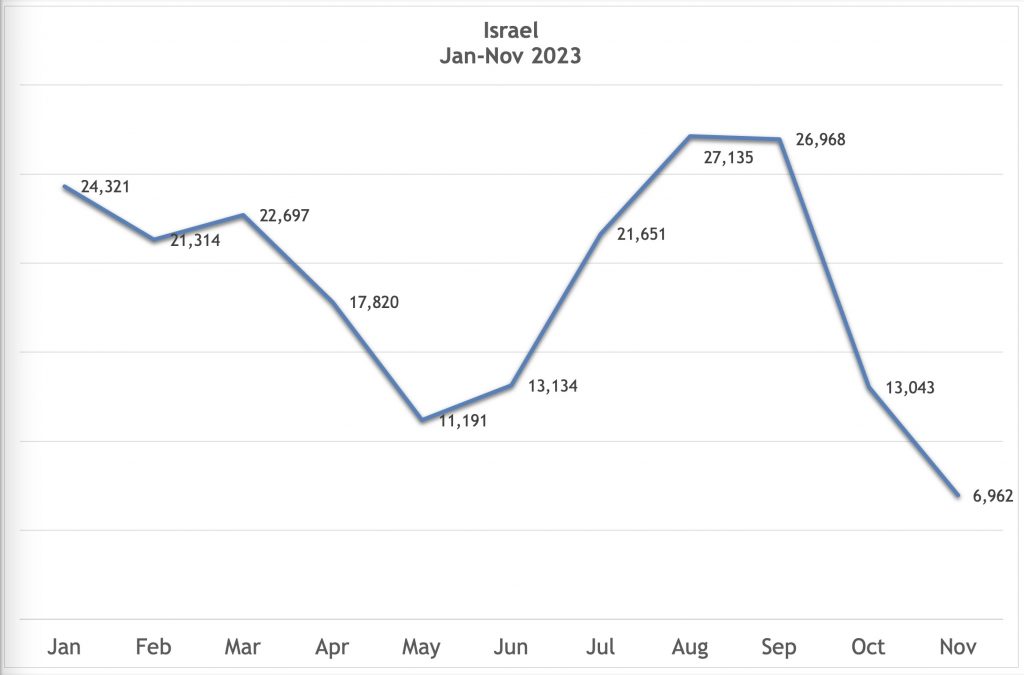

Israel

By contrast, travel has taken a huge hit as a result of the ongoing conflict in the Middle East. Visitors to Thailand have plummetted, with no end in sight.

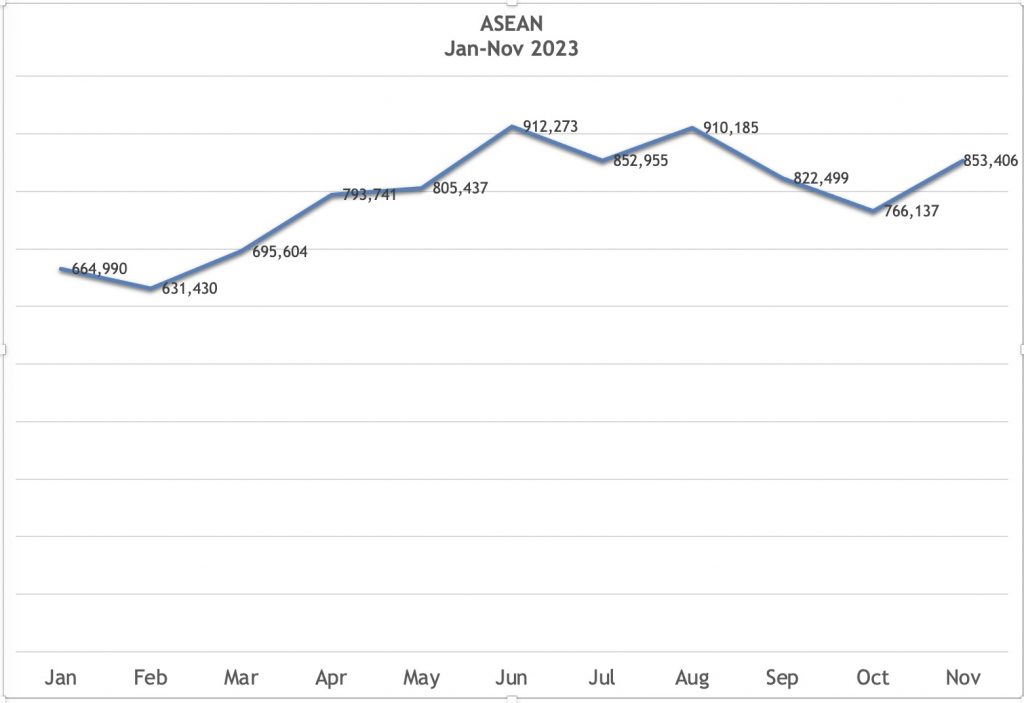

ASEAN

Thailand’s ASEAN neighbours will always be a good source of arrivals, thanks to visa-free access, good air, land and sea transportation links and strong demand for the high-quality Thai products and services. However, arrivals from Malaysia alone comprise about half of the total, which means a lot more can be done to facilitate two-way tourism with the other ASEAN countries, especially Vietnam, Indonesia and the Philippines. Regrettably, Myanmar remains a millstone around the ASEAN neck, dragging the entire region down. Another dismal example of how conflict impacts tourism.

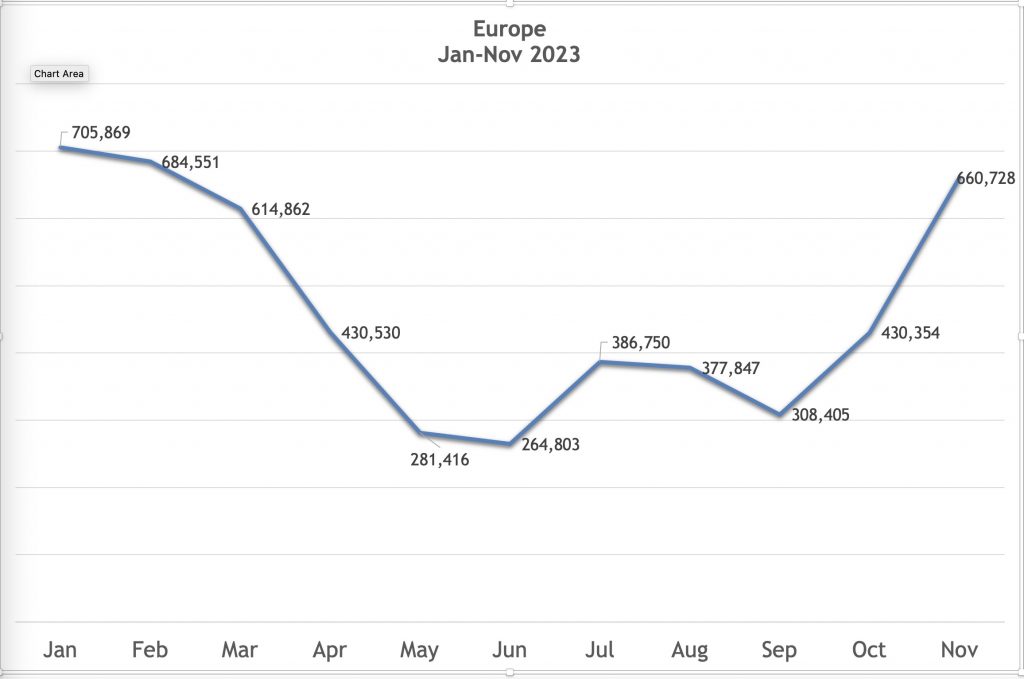

Europe

Europe as a whole is recovering but its market share has fallen significantly over the years. However, it still has the longest average length of stay but a low average daily expenditure. Also likely to be hit in 2024 if the Russia-Ukraine conflict worsens.

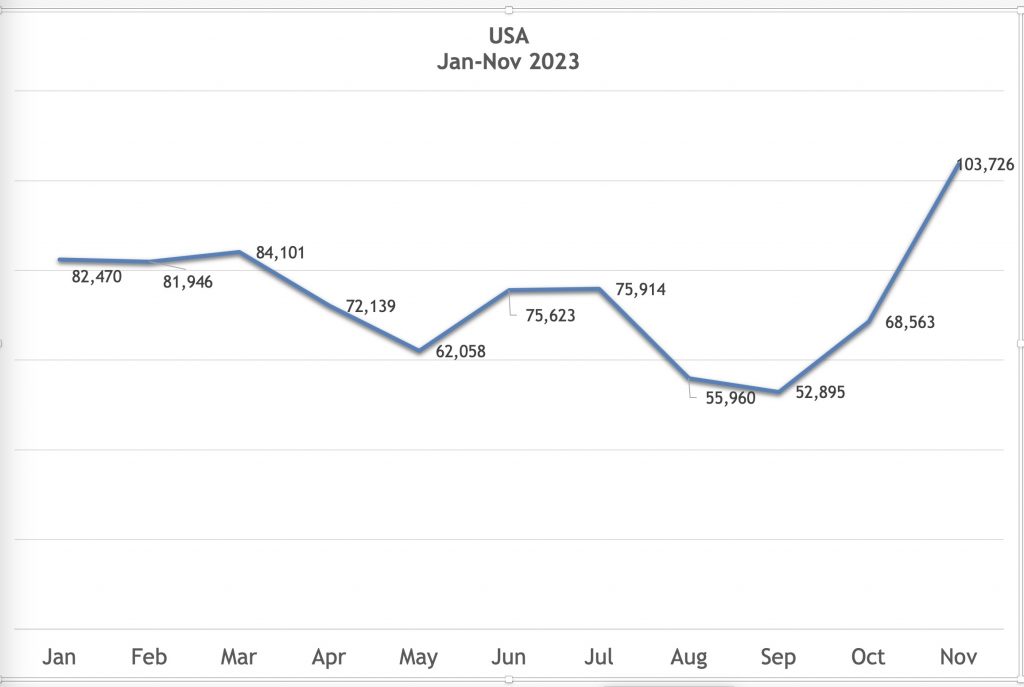

USA

The reason for the surge in arrivals in Oct – Nov is not exactly clear. Nevertheless, it’s good news. Next year will be an election year, which raises the possibility of a slowdown, if not a decline.

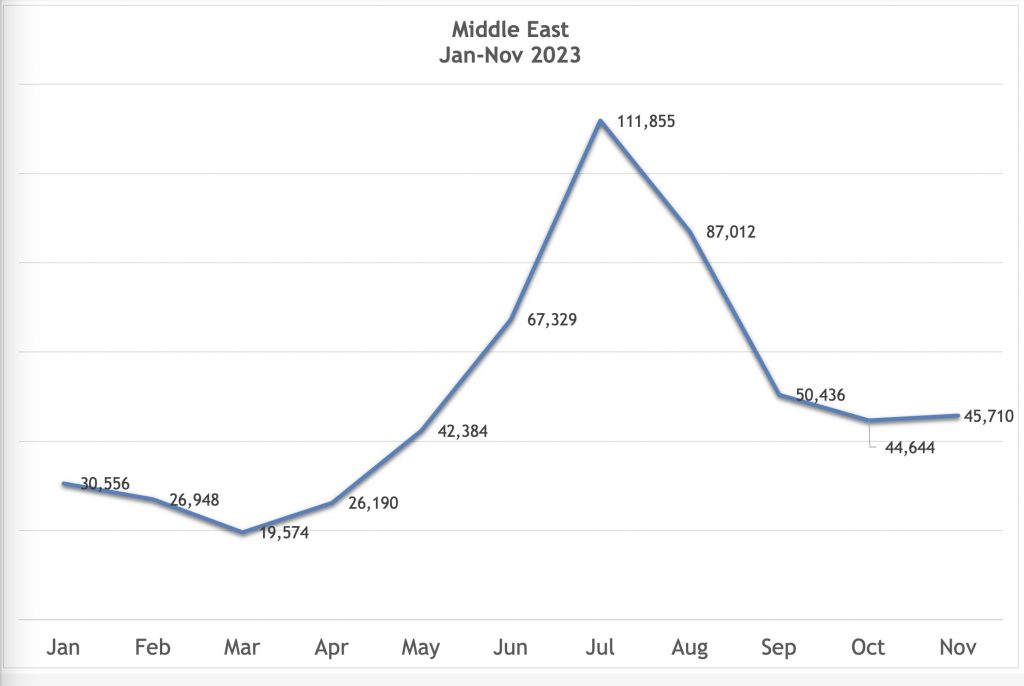

Middle East

Like Europe, this is an extremely seasonal market, with small numbers emanating from multiple countries but high spenders. It, too, is likely to be hurt if the Israel-Palestine conflict worsens.

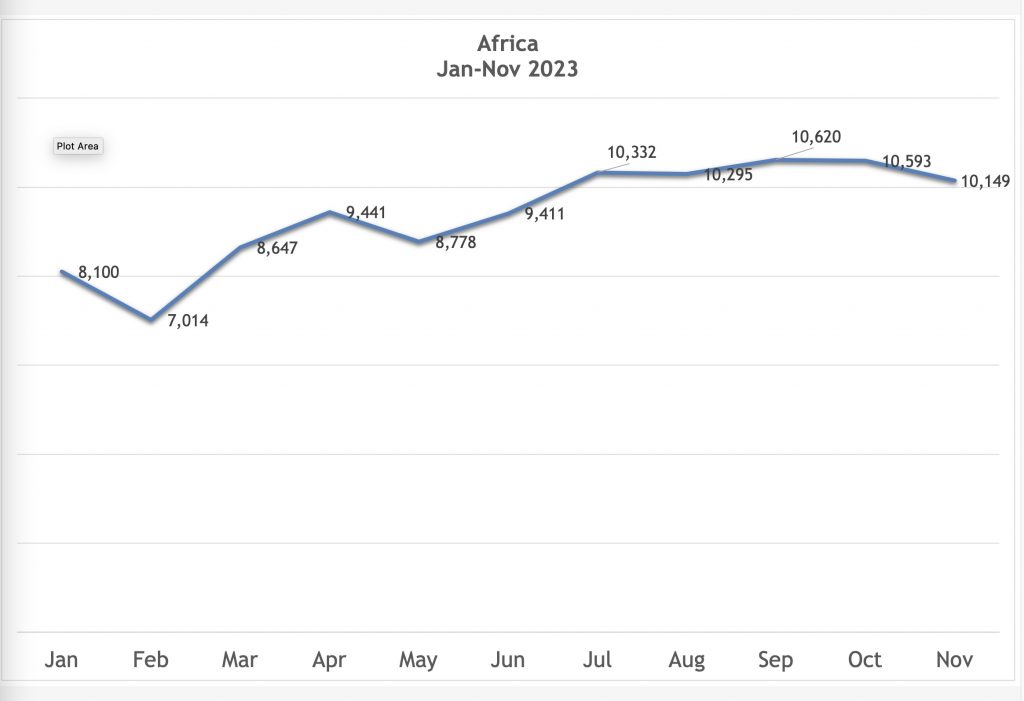

Africa

Minuscule numbers today means a huge opportunity for Thailand tomorrow. Emerging from the economic backwaters, the continent is high on the priority list of the Ministry of Foreign Affairs for expansion of trade, tourism and transport linkages with Thailand and ASEAN. But there is a long way to go to relax visa restrictions, open more aviation links and step up tourism marketing.

Conclusion

Thailand’s powerful brand image and diversity of tourism products and services, plus powerful marketing campaigns, will always attract visitors. The post-Covid bounceback is clear evidence of its underlying strengths.

The biggest risk and threat remain more external shocks. Covid was the worst ever. Multiple think-tanks and business consultancy groups are now citing geopolitical volatility as the next potential external shock just waiting to strike.

Thailand, and the world at large, cannot afford to be hit by another man-made crisis. Maximum diplomatic, political and business pressure will need to be exerted to avert it.

Liked this article? Share it!