18 Sep, 2020

Debt.com survey: When health suffers, finances go on life support

The economic fallout will be the next chapter of the Covid-19 crisis, impacting countries, communities and societies for years after the health issues are resolved. Dealing with that, too, will require money — lots and lots of it. Where will it come from?

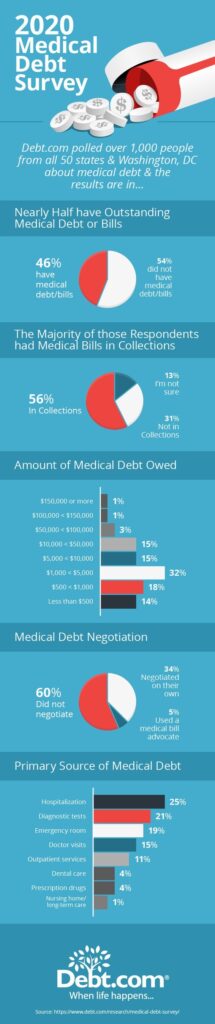

FORT LAUDERDALE, Fla., 16 September 2020, PRNewswire – Even adults who do not contract COVID-19 are facing a healthcare crisis. A Debt.com survey of more than 1,000 American adults reveals 56 percent of respondents had medical debt sent to collections and nearly two-thirds owed under $5,000, while 5 percent owed over $50,000.

According to respondents, hospitalization accounts for a quarter of the medical debt. The next three causes are:

- Diagnostic test (X-rays, MRIs, lab fees) – 22 percent

- Emergency room visits – 19 percent

- Doctor visits – 15 percent

“We often hear horror stories about chronic conditions or complicated surgical procedures that drive up medical bills to shocking levels,” notes Debt.com president Don Silvestri. “This survey shows that even smaller amounts can overwhelm your income and savings. The result is a debt collector pursuing you.” Very few Americans know that there are experts who can help them deal with medical debt negotiations and collectors.

Surprisingly, 60 percent of respondents didn’t try to negotiate medical debt payments or their bill, whereas nearly 35 percent did negotiate on their own. Just under 5 percent used a medical billing advocate.

Debt.com advises asking these five questions if medical debt is sent to collections:

- Can the collection agency verify the debt?

- Can I dispute the debt?

- Is the debt outside the statute of limitations?

- Can I stop medical debt from hurting my credit?

- Can I work out a settlement or payment plan?

“Just like every other form of debt, there are professionals who can help you,” Silvestri says. “Whether it’s credit cards, student loans, or medical bills, not consulting a pro can literally cost you.”

About: Debt.com is the consumer website where people can find help with credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com works with vetted and certified providers that give the best advice and solutions for consumers ‘when life happens’.

Liked this article? Share it!