6 Feb, 2019

The best analysis of Thailand’s 2018 record-breaking visitor arrivals

Bangkok — A detailed and comprehensive analysis of Thailand’s 2018 visitor arrivals and expenditure released by the Ministry of Tourism and Sports last week show some fascinating results that will have long-term implications for Thailand, ASEAN and the entire Asia-Pacific region.

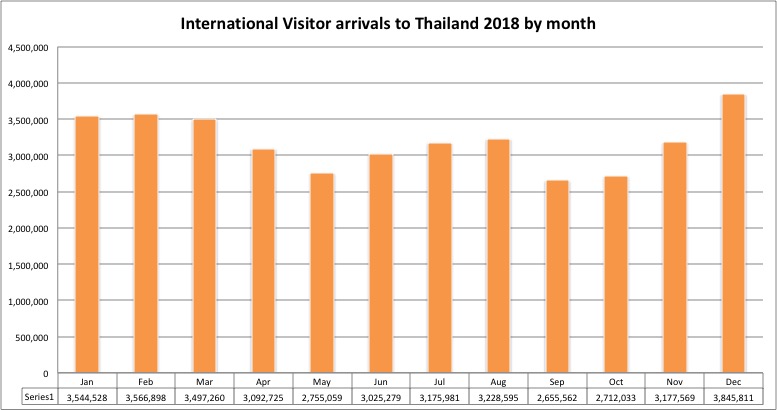

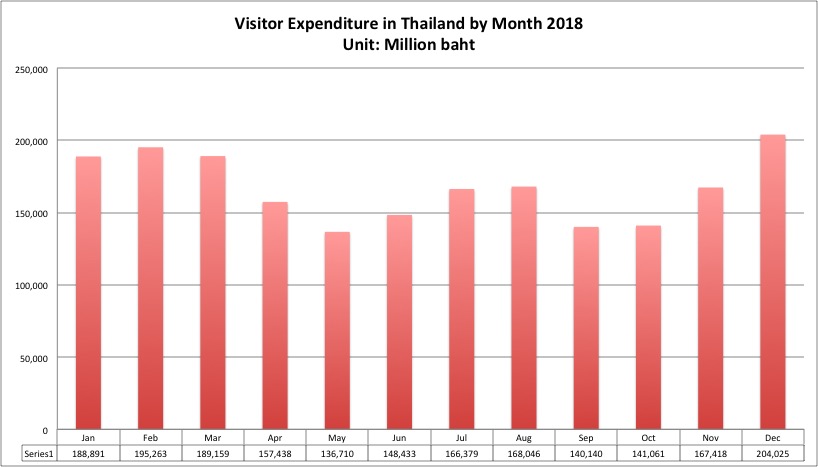

The two charts below show total Thai visitor arrivals and expenditure by month. More detailed charts of the same stats from the Top 20 source markets (which comprise about 90% of the total) are covered in two Excel files which can be downloaded by clicking on the images below. Important Note: All figures are preliminary.

Source: Ministry of Tourism and Sports. Click on the image for details of the stats from the Top 20 source markets,

Source: Ministry of Tourism and Sports. Click on the image for details of the stats from the Top 20 source markets,

The following analysis of the 2018 arrivals covers both the implications of this continued growth as well as some of the emerging challenges:

(+) Chinese visitor arrivals bounced back in December, proving that memories are short. The 05 July 2018 boat accident in which 45 Chinese tourists perished impacted Chinese visitor arrivals for only four months. The business interests of the airlines, the inbound and outbound sectors in both countries and the marketing genius of the Tourism Authority of Thailand can drive recovery campaigns to overcome any crisis.

(+) Over-success is set to breed its own set of problems. Thailand is becoming over-exposed to the Chinese market. China now comprises 27% of total arrivals and 29% of total expenditure, and growing. Efforts are being made to balance this by stepping up marketing in the ASEAN countries and India. This may not significantly reset the market share, but it will certainly boost total visitor arrivals, creating more management pressure at the destination level.

(+) The Asia-Pacific region, including Australia and New Zealand, now comprises 76% of the market share. This will grow in future, leading to significant changes in marketing strategies and budget allocations.

(+) Intra-ASEAN travel is also soaring. With the exception of small-population Brunei, the ASEAN countries are firing on all cylinders. Thailand’s neighbours in the Greater Mekong Subregion (the formerly ‘poverty-stricken, war-torn’ countries of Laos, Cambodia and Vietnam) are now all in the Top 20 source-markets.

(+) The seasonality factor is almost gone. In the former days of dominance by inbound arrivals from Europe and North America, the peaks and troughs between the winter high and summer low season months were clearly discernible. No longer.

(+) Europe still remains a largely seasonal market. Although total arrival numbers are growing, the rate of growth is much slower than the Asian countries. Europeans still dominate in average length of stay but their average per capita expenditure is stagnant. The TAT has already reacted to this by shifting European marketing funds to niche-markets such as health & wellness, gastronomy tourism, female visitors, and secondary cities of Europe.

(+) Transport connectivity has delivered results big time. Aviation liberalisation campaigns waged in the 1990s to end the archaic bilateral traffic rights regimes have paid off. The opening of Suvarnabhumi airport freed up Don Mueang to accommodate the low-cost airlines. In future, more domestic airports will become international, even as the existing international airports exceed their carrying capacity, requiring expansion and upgrade. The Asian Highway and its tributary road network is now in place, which will mean more cross-border traffic via Thailand’s land-borders with Malaysia, Cambodia, Laos and Myanmar. More rail and cruise networks are in the pipeline, which will open up the floodgates even further.

(+) As and when they become publicly available, more detailed figures will show interesting trends, including shifts in average length of stay, sex ratio, and demographic changes.

Conclusion — Thai Tourism Now Too Big To Fail

The Thai tourism industry has become too big to fail, but now requires a total restructuring. It is no longer an industry of leisure, recreation and relaxation but a vital economic force that can ill-afford to be disrupted by any kind of crisis, whether local, regional or global. Hence, Thailand has a vital interest in maintaining both local, regional and global peace as well as economic and ecological “sustainability.”

Regardless of all the talk of “overtourism,” the country’s unmatched geographical location at the heart of the world’s most populous region means that there will be no shortage of numbers. But the cost of managing and delivering services to the growing hordes of visitors will rise significantly. Over-investment will now be required in environmental protection, education and training, and the long-neglected foundations of travel & tourism.

Just as it led the world in tourism marketing dating back to the historic 1987 Visit Thailand Year, so too can Thailand lead the world in tourism management.

To do this, Thailand will need to develop and create three vitally-important measurement indicators: 1) The number of jobs created by tourism, 2) the tax contribution of tourism enterprises and 3) the environmental impact of tourism, including consumption of natural and energy resources and disposal of garbage, sewage and all forms of waste. None of these stats are popular in the public domain today. Today, the result of marketing campaigns can easily be analysed by tracking visitor arrivals. Statistical indicators to measure the impact of tourism management will similarly need to be created and popularised.

The current five-year National Economic and Social Development Plan for 2017-21 focusses on a theme slogan “Thailand 4.0.” In theory, it strives to prioritise the Sufficiency Economy, conceptualised by the late monarch King Bhumibhol Adulyadej. This, along with the UN Sustainable Development Goals, must become the core strategies driving the future management of Thai tourism. Another opportunity to walk the talk lies in Thailand’s status as chairman of ASEAN for 2019. The country has chosen as its theme slogan “Advancing Partnerships for Sustainability.” Travel & tourism can be a critical partner in contributing to the success of that slogan.

In 2020, the Tourism Authority of Thailand and Thai Airways International, the two founding pillars of Thai tourism, will turn 60, marking their auspicious 5th cycle anniversary. Similar to Thai government officers who retire at that age, and start reflecting on their future, turning 60 is a good time for Thai tourism to indulge in some heavy-duty Soul Searching about its past, present and future.

Liked this article? Share it!