4 Jul, 2014

Flawed research on APD “success story” does PATA a disservice

Bangkok – The Pacific Asia Travel Association has produced a special edition of Issues & Trends to discuss the subject of travel taxes, with a particular focus on the UK Air Passenger Duty. Drawing upon a number of studies by PriceWaterhouseCoopers, the International Air Transport Association, the World Travel & Tourism Council, the Tourism & Transport Forum and the Caribbean Tourism Organisation, the June 2014 edition strives to build what PATA CEO Mr. Martin Craigs calls a “compelling case” about the alleged harm done to travel & tourism globally.

In fact, it is a flawed and selectively-argued study which, beneath the camouflage of sexy-looking charts and graphs, does little to prove the point it strives to make. Instead, it opens up serious questions about the quality of research being produced by PATA and its usage in support of the “aligned advocacy agenda”.

The treatise’ central argument against the APD is that it impacts on UK travel and its four-band structure unfairly penalises the long-haul destinations. Extended arguments are then raised about the role of taxation in general, especially the “unfair tax burden” carried by the aviation sector as against other forms of transport as well as other “sin taxes” levied by governments on alcohol, tobacco and firearms.

The primary rebuttal against the entire treatise is that it fails to conclusively prove how the APD has affected travel out of the UK and specifically to the PATA destinations. It cites figures to the Caribbean destinations, but the Caribbean countries are not PATA members. In spite of that, the paper says, “This is one of the very occasions that a tax on travel has been clawed back. So it is a real success story, even if there is more work to do to realise the full benefits to the UK economy and the travel industry.”

The APD’s guilt remains unproven beyond reasonable doubt

The travel & tourism industry is full of onerous taxes, duties, fees, levies and surcharges. It is also affected by geopolitical and economic conditions, exchange rates, marketing budgets, promotional campaigns, seasonality and assorted forms of crises. In the midst of these variables, it becomes impossible to prove the precise role of the APD in the decision-making process on choice of destination by UK travellers. Cumulatively they all add up but there is no way of unbundling them to pinpoint the impact of the APD as against other factors.

The case against the APD was being made by the New Zealand travel industry long before Mr. Craigs even joined PATA. Even that submission by the NZ Tourism Industry Association to the UK Treasury on the Reform of Air Passenger Duty (APD) 17 June 2011 admitted, “It is well established that the volume of air travel is affected by fare levels and while the APD on its own may not be a deterrent to travel, it is for long haul travellers when combined with exchange rate impacts, increased fare prices and less discretionary spending across the whole economy.”

What about aviation fuel surcharges?

The PATA study does not consider any of these “combined-with” factors. One such factor, much too obviously missing in the study, is aviation fuel surcharges, a major contributor to increased air fares. These have been yo-yoing for years. They are levied by the airlines at will and often total up to more than the APD. Has PATA studied the impact of aviation fuel surcharges on travel and their role in influencing choice of destinations? Why selectively pick on the APD? Perhaps because PATA and IATA are both members of the Global Tourism Association Coalition and only seek to focus on external factors that impact their business, not their own actions which, somehow, are always considered to be justified and right.

Aviation fuel surcharges are impacted by oil price fluctuations which are triggered by everything from commodity speculators to wars and natural disasters. When countries such as the UK squander billions of taxpayers money to attack countries in the Middle East, they directly trigger higher oil prices. The airlines then levy fuel surcharges which affect travel. The broader economic impact leads to reduced tax collection, which governments then have to find ways of recouping. Taxing travel becomes a tempting option. The vicious cycle turns. Indeed, unanswered questions abound about the transparency-factor in the way airlines levy and adjust fuel surcharges in relation to vagaries in oil prices.

All these factors have a far greater impact on travel than the APD. By ignoring them entirely, the PATA Issues & Trends paper affects its own credibility.

If the APD had any impact at all, it doesn’t any more

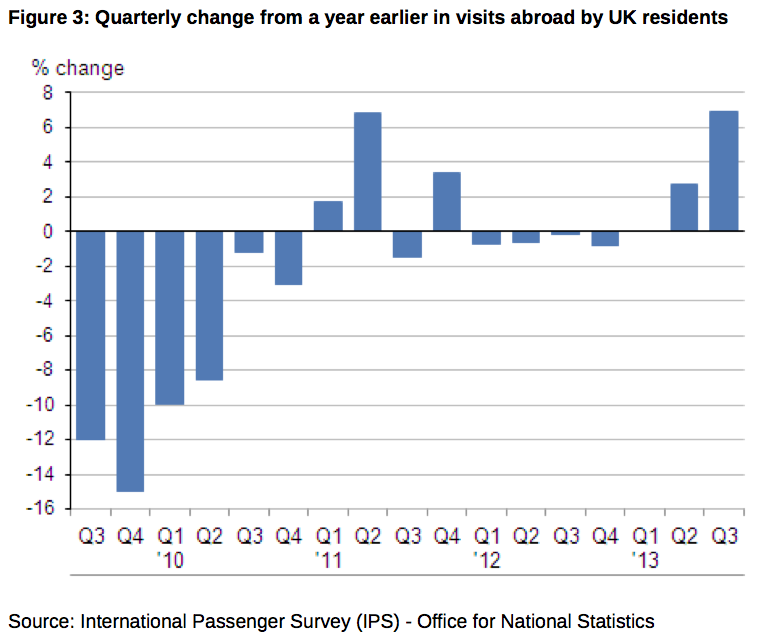

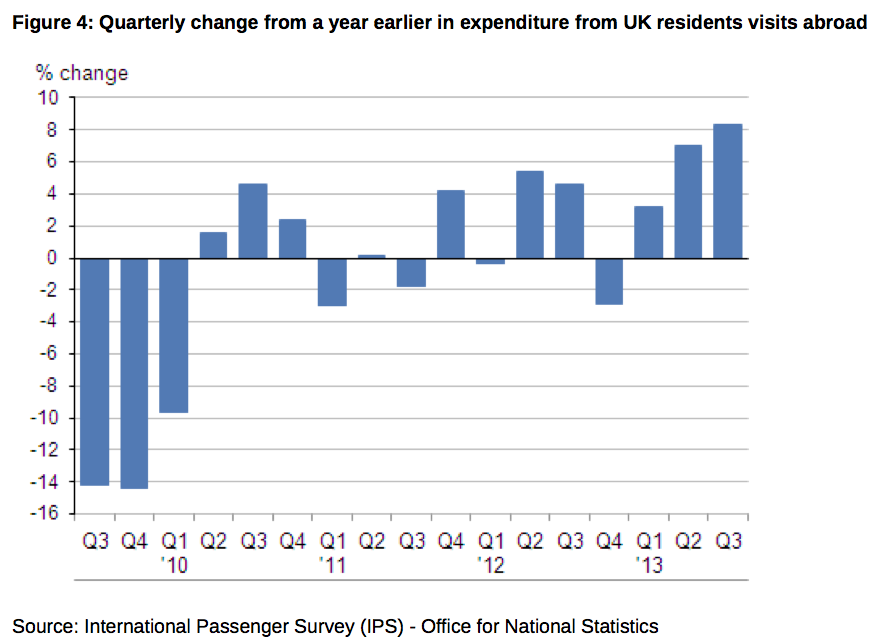

Although UK outbound travel figures are easily available from the UK National Statistical office website, they are not cited anywhere in the PATA paper. They clearly show that travel was last heavily impacted in 2010, because the UK was in economic doldrums, not because of the APD. As the charts below show, when the economy improved, so did both travel and travel expenditure.

=========

Says the UK National Statistical Office report for the third quarter 2013 period, published in January 2014, “In quarter 3 2013, there were 14.6 million (outbound from UK) holiday visits which was an increase of 6.8% compared to the same quarter a year ago. Visits to friends or relatives increased by 12.3% in this quarter, compared to the same period in 2012, and business visits fell by 4.8%.

“In quarter 3 2013 the number of nights spent abroad by UK residents was 241.2 million, this was up 9.2% compared with quarter 3 2012. With the number of visits to North America increasing, the overall number of nights spent there by UK residents also increased by 12.1%. Nights spent in Europe also saw a rise of 6.2% in this quarter and there was also a rise of 17.1% for nights spent in ‘Other countries’.

“UK residents spent £12.7 billion on visits abroad in quarter 3 2013, an increase of 8.3% on the £11.8 billion spent in the same period of 2012. Expenditure in North America was up by 9.4% while spending in Europe and ‘Other countries’ increased by 7.4% and 11.4% respectively.”

These stats alone cast doubt on the claim that the APD is impacting on UK travel as a whole.

Not all destinations are affected

The APD may be having an impact on some destinations but many others are doing fine. A number of PATA destinations are reporting healthy increases in UK visitor arrivals, as follows:

UK Visitor Arrivals to Selected Asian Destinations 2011-13 |

|||||

| 2011 | 2012 |

% Change 2011/12 |

2013 | % Change 2012/13 | |

| Cambodia | 104,052 | 110,182 | 5.89 | 123,919 | 12.47 |

| Malaysia* | 403,940 | 402,207 | -0.43 | 413,472 | 2.80 |

| Singapore | 442,611 | 446,497 | 0.88 | 461,459 | 3.35 |

| Thailand | 771,466 | 800,072 | 3.71 | 847,678 | 5.95 |

| Vietnam | NA | 170,346 | NA | 184,663 | 8.40 |

| ========= Note: *All tabulated by Country of Residence except Malaysia (by nationality). Sources: Cambodia Tourism, Tourism Malaysia, Singapore Tourism Board, Tourism Authority of Thailand, Vietnam National Administration of Tourism. |

|||||

Why do some destinations do better than others? Among the many reasons could be better marketing campaigns, a more powerful brand-image, good value for money, and many more. Another very valid reason would be good airline links. Gulf airlines are now flying into Bangkok upto thrice daily, ferrying UK passengers from London, Birmingham and Manchester via their hubs in Doha, Abu Dhabi, and Dubai.

The PATA paper offers no evidence that people who had the desire and the means to travel deferred their travel plans as a direct result of the APD. Obviously, they just found ways to adjust their choice of destinations, hotels and other travel expenses in line with their budgets. And travel did not have to be a foreign destination; it could also be a domestic one. To institutions such as the UN World Tourism Organisation, it makes no difference. Either way, travel creates jobs, whether at home or abroad, and governments have every right to encourage domestic travel. Many are doing exactly that.

Other key issues

The PATA paper argues vigorously against a broad swathe of taxation in the aviation sector. That, too, is a selective way of looking at it. There is not a single sector in the travel industry, nor any economic or business sector worldwide, that does not seek lowered or zero taxes. The standard operating Orwellian claim, repeated in the PATA paper, is that less is more: Lower taxes will help governments generate more tax revenue by boosting business.

But tourism is a heavy guzzler of public taxpayer money. Which leads to the counter-argument that no-one has ever done a detailed study of how much it costs local taxpaying citizens to service foreign tourists in terms of providing infrastructure, security, water, energy, sanitation, garbage disposal, etc. If travel & tourism industry researchers would start producing some numbers in that area, it may yield a better understanding of why taxation is necessary, for both foreigners and locals, and how the tax burden should be divided.

Also important is the need to ensure transparency and accountability about the reasons cited to levy taxes. If the APD is now being positioned as some kind of environmental protection measure, then the travel industry would be well within its rights to demand measurable proof of whether this goal has been met. If not, that alone would become a strong argument for the tax to be dropped. PATA has never sought such proof.

In the absence of that, for the aviation industry to constantly seek lower taxation is like the pot calling the kettle black. The airline industry has become a master of creative revenue generation by charging outrageous amounts even for changing reservations. At the same time, it sends out mixed signals, especially the low-cost airlines; they advertise low fares and seek major concessions from governments and airports, and then charge a fortune for sandwiches and water. If their own less-is-more Orwellian arguments are true, they should charge less for sandwiches and water so that they can sell more, and hence make more.

Paradoxically, the travel & tourism industry invites the attention of the taxman by constantly trumpeting its huge contributions to economic growth and GDP. Like cigarettes and alcohol, travel IS considered a non-essential. It gets taxed because all governments need the money. If PATA complains about unfair tax burdens, it should take a closer look at the multinational companies, such as the members of the World Travel & Tourism Council, which are masters at evading/avoiding tax by using transfer-pricing mechanisms and tax havens, including those located in the Caribbean. Currency speculators, hedge-fund managers, commodity traders, many of them sitting in the City of London, are also masters at avoiding tax. The OECD and the EU are spearheading efforts to go after them. If they paid their fair share of taxes, especially come bonus-time, governments would not need to tax airline passengers. But don’t expect the travel & tourism industry to raise a voice against them any time soon.

Finally, the travel & tourism industry as a whole would be better off monitoring how its taxes are spent. The best way would be to muster the courage to prevent them from bolstering military and defence budgets. Wars, conflict and violence are the worst enemies of travel. They are the primary cause of both restrictive visa policies and outrageous security costs. Again, this connection has never been adequately researched. Again, don’t expect the travel & tourism industry to raise a voice on this issue either.

Conclusion

The UK Government’s adjustment of the APD is nothing but a token gesture designed more to simplify the collection process. The government kept the revenue stream intact. The dozens of taxes, surcharges and fees in travel are are only going to get worse. As of this writing, the Indonesian government has just raised the fees for visa on arrival by US$10. Is PATA going to protest that?

Railing against the APD is a nice publicity stunt, designed to grab headlines. Mr. Craigs has his own agenda. He needs to bring in more airline members and bolster PATA’s finances in his bid to seek an extension of his three year contract which ends in a few months. Using PATA’s once formidable research capabilities to advance this agenda has done the entire organisation a disservice.

Liked this article? Share it!