17 Feb, 2014

January 2014 Thai tourism stats show impact of political unrest

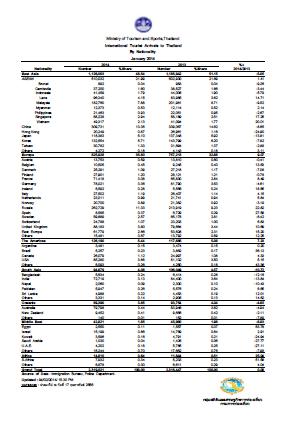

BANGKOK – Visitor arrival figures for January 2014 released earlier today confirm the extent of the damage being caused by the ongoing political unrest in Thailand. The total arrivals of 2,319,821 were virtually the same as 2,318,447 in January 2013, meaning that a growth level of probably more than 20% that may otherwise have materialised in the high-season month dissipated entirely.

Arrivals were down from nearly all major source-markets: Chinese visitor arrivals in January 2014 were down -8.65% over January 2013 to 309,731, Malaysia down -9.52% to 182,760, Japan down -13.81% to 118,383, Korea down -7.82% to 132,554 and India down -13.84% to 84,400. These five countries are among the six that generate more than one million arrivals a year for Thailand. The only other million-figure country to save the day was Russia which was up +22.82% to 262,729.

Apart from Russia, two other European countries that reported growth were France +8.49% to 71,418 and United Kingdom +10.69% to 88,183.

The slowdown actually began in September 2013 when arrivals totalled 2,056,405, down sharply from 2,469,160 in August 2013, largely due to the Chinese crackdown on zero-cost tours. The monthly arrivals remained roughly the same at 2,065,518 in October and began rising again to 2,399,240 in November and 2,598,015 in December.

Russia was the most important factor in this rise: Monthly arrivals from this country surged from 73,240 in September 2013 to 260,613 in December 2013.

As a result, total arrivals for November 2013 were up 11% over November 2012 and the December 2013 arrivals figure was up by a slower 6.67% over December 2012. In fact, the figure would have been much higher had there been no political unrest and all markets had grown normally.

Now in January 2014, the arrivals count is a stagnant change of a mere +0.06% over January 2013 and an actual decline of 10.7% over December 2013. There is an even chance that February 2014 arrivals will show another outright decline, as tourists head elsewhere.

The January 2014 arrivals would have been worse had it not been for a number of bright spots. In addition to the growth from Russia, UK and France mentioned above, arrivals from Singapore were up +17.25% to 68,228; the USA was up +5.15% to 85,280, Brazil was up +26.12% to 5,257 and Laos, a market showing great future promise although confined largely to the border areas, was up +14.71% to 96,340. Europe as a whole was up +9.07% to 825,928.

Set to be analysed much more closely over the coming months, the figures are likely to lead to sweeping changes in marketing, infrastructure development and transportation accessibility policies in Thailand, the ASEAN region and across the Asia-Pacific over the next few years.

(+) Shifting away from capital cities as the primary point of entry will now become well-entrenched policy. Upcoming figures from the Airports of Thailand will show that the main gateway city of Bangkok was worst hit while Phuket airport grew strongly as the first point of entry for visitor arrivals. The southern Thai island resort will now be developed as a major hub in its own right, especially after the opening of a new terminal at Phuket airport.

(+) The impact of low-cost airlines now flying directly to other secondary cities such as Samui, Chiang Mai, Chiang Rai, Krabi, etc will also become apparent, paving the way for regional governments to further diversify their first points of entry.

(+) The positive impact of Gulf airlines will also become apparent, especially as conduits for generating more demand from emerging and untapped global cities and channelling them to Asian destinations via their respective hubs.

(+) The TAT is set to make major adjustments in its marketing plans and budgets. Considerable amounts will be channelled into reviving the short-stay but high-spending Asia-Pacific markets.

(+) The bottom-line result will be a huge shift away from capital cities as the first point of entry, and enhanced access for secondary cities. This will mean a slew of new infrastructure requirements which, in the long run, will also benefit national development plans to more evenly balance the distribution of income.

At root cause, the arrivals slowdown will put pressure on all sides of the political spectrum in Thailand to work harder at settling their differences. As the slowdown begins to have a signficant ripple-effect and threaten jobs and livelihoods at the grassroots level, the TAT is pressing ahead with a recovery campaign that will see the first batch of nearly 100 media from various parts of the world arriving in Thailand this week to see the situation for themselves.

Travel Impact Newswire Executive Editor Imtiaz Muqbil has compiled all the Thailand visitor arrivals figures by month covering the entire year of 2013 and January 2014. This has taken a good deal of effort and will not be given free. Please make a small contribution of US$50 via this Paypal link and the file will be sent by email.

Liked this article? Share it!