11 Jul, 2013

Travel to benefit by more competition in mobile communications, says OECD

Paris, (OECD media release), 11/07/2013 – OECD countries must ensure mobile markets remain open and competitive in order to sustain innovation and meet rising demand for data services, according to a new OECD report. It indicates that travel could be a major beneficiary of this.

Communications Outlook 2013 says that revenues from data services are growing at double-digit rates in most OECD countries and, in line with the surge of broadband wireless subscriptions, are now the main source of growth for network operators. But many will increasingly need to rely on offloading traffic to fixed networks, as demand tests the available spectrum.

Policy makers and regulators might need to intervene to ensure there is enough supply to meet demand, especially in countries or areas where there is insufficient fixed access network competition.

Just as critical is the level of facilities based competition among mobile networks. France and Israel’s mobile markets have become more competitive after the entry of new mobile network operators. The Czech Republic and The Netherlands are both introducing additional operators. Meanwhile, in Canada and the United States, the authorities acted to head off mergers that would have resulted in less facilities based mobile network competition. The outcomes will be at least four national operators in all these countries.

Published every two years, the OECD Communications Outlook provides an extensive range of indicators for the development of different communications networks and compares performance indicators such as revenue, investment, employment and prices for service throughout the OECD area.

It also makes a number of references to the problems faced by the travel industry. For example, the report says, “A growing number of industry leaders claim high prices for international mobile roaming are detrimental to their relationship with their customers, and a significant barrier to trade and travel in OECD economies. The OECD Recommendation of the Council on International Mobile Roaming Services (February 2012) recommends assessing and removing barriers that may prevent access by mobile virtual network operators to local wholesale mobile services to offer roaming services.”

One reference is to the cost of calls between China and the OECD countries, thus:

“Since 2011, competition among international roaming services provided by China’s three operators has increased substantially. China Mobile, for example, decreased its international roaming fee six times between 2010 and 2011. China’s consumers roaming in many OECD countries can make local calls at prices lower or equivalent to those paid by local users. Prices to call back to China from these countries can be 10 times less expensive than a call in the opposite direction for a consumer from an OECD country. MIIT say that the lower prices are the result of successful negotiation with foreign operators to reduce wholesale rates. This may reflect increasing travel by consumers from China, but raises the question as to why similar rates seem unavailable between OECD countries with large amounts of travel. It also begs the question of why the benefits of these lower rates are not evident for OECD consumers travelling to China, given that the wholesale rates are likely to be reciprocal.”

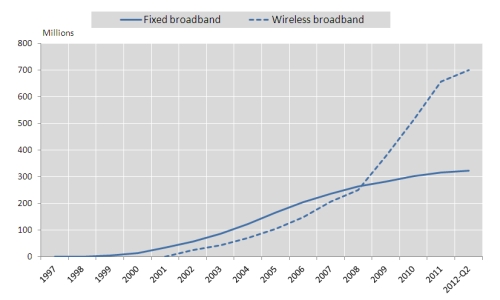

Wireless and fixed broadband subscriptions in OECD countries

Note: Data for Wireless broadband from 2001 to 2007 are estimates.

Prices for mobile voice services have decreased markedly from 2010 to 2012, showing significant declines across all consumption patterns, says the report. A laptop-based wireless broadband basket (offers within the 500 MB per month range) costs USD 13.04 on average across the OECD in PPP terms, although it reaches USD 30 in some countries. Average expenditure was USD 37.15 PPP for a 10 GB basket. A 250 MB tablet package cost USD 11.02 PPP per month on average and a 5 GB basket for tablets cost USD 24.88 PPP on average.

The Communications Outlook 2013 also highlights the urgent need to move forward with IPv6 in order to keep wireless markets open to new entrants and meet demand. Asia Pacific and Europe have run out of Internet Protocol version 4 (IPv4) addresses under normal procedures. Africa, North America and South America will use up their allocated address space in due time. IPv6 allows a virtually unlimited number of addresses but although over half the equipment deployed on the wired Internet is capable of supporting IPv6 today, less than 1% of this equipment connects to a service that provides IPv6.

Key findings

In 2011, the total number of OECD communication access paths was 2 066 million, or 166 subscriptions per 100 inhabitants. Mobile subscriptions represented 65.4% of paths, versus 64% in 2009, and traditional fixed telephony subscriptions continue to decline. Fibre broadband subscriptions grew at 16.61% year on year between 2009 and 2011. Greater use of mobile broadband access has been stimulated by the popularity of smartphones. The average subscription rate of mobile Internet access in OECD countries as a whole rose to 56.6% in June 2012, up from just 23.1% in 2009.

Prices for fixed telephony and, more markedly, for mobile voice services decreased from 2010 to 2012, showing significant declines across all consumption patterns, with the exception of fixed business services.

A laptop‐based wireless broadband basket (offers within the 500 MB per month range) cost USD 13.04 on average across the OECD in PPP terms, although it reached USD 30 in some countries. Average expenditure was USD 37.15 for a 10 GB basket. A 250 MB tablet package cost USD 11.02 per month on average. A 5 GB basket for tablets cost USD 24.74 on average, but varied from USD 7.98 (Finland) to USD 61.84 (New Zealand).

Previously distinct communication services are converging rapidly, while digitalisation plus the rolling out of fixed and wireless infrastructures are expanding the bandwidth available for all types of communication services. Examples from the Internet include the quick uptake of the long‐term evolution (LTE or 4G) standard for mobile networks based on Internet Protocol (IP)‐only architecture and using Voice over LTE (VoLTE) as an application; and IP‐based Video‐on‐Demand and live‐streaming television services by cable companies, satellite providers, public broadcasters, and cloud‐based and other “over the top” (OTT) providers.

Telecommunication revenues experienced a notable decline in 2009 but stabilised in 2010 and rebounded in 2011. This can be attributed to the strength of mobile communication markets and specifically to the rapid increase in smartphone penetration during this period. By far the greatest traffic generated by smartphones or tablets is linked to the use of Wi‐Fi associated fixed networks, rather than cellular networks. Fixed networks have, in effect, become the backhaul for mobile and wireless devices with some studies claiming that 80% of data used on mobile devices is received via Wi‐Fi connections to fixed networks.

Revenues corresponding to data services are growing at double‐digit rates in most OECD countries, and transport of data is now the major source of growth for network operators. While there are significant opportunities in new services such as mobile payments, essentially these involve the transport of data in association with partners such as credit companies. Few expect growth in traditional services such as telephony or SMS as measured by their share of revenue.

The key to the success of the mobile ecosystem has been the presence of sufficient competition in the provision of network infrastructure and services. This competition drove some operators to open and share their access to customers with far more success than could have been achieved under the imposition of regulatory arrangements.

The Internet is still growing strongly, but relative growth has decreased compared to previous periods in some categories, as might be expected given widespread adoption of this technology. The Internet, together with analogue audio broadcasting, has become the primary distribution method for audio content. The conversion to digital television is almost completed in the OECD area. In many countries, broadcasters offer their content either live or via catch‐up television over the Internet. Subscription video‐on‐demand services are seeing rapid adoption.

Emerging issues

Policy makers and regulators have a vital role to play in ensuring sufficient competition. This includes making sure there is adequate available spectrum, abundant IP addresses or other numbering resources for new market entry, and fair competition between operators and OTT providers.

Ensuring markets remain open to OTT and facilities‐based providers is essential to innovation in broadband infrastructures, and critical to addressing major industry and broader economic and social challenges.

A growing number of industry leaders claim high prices for international mobile roaming are detrimental to their relationship with their customers, and a significant barrier to trade and travel in OECD economies. The OECD Recommendation of the Council on International Mobile Roaming Services (February 2012) recommends assessing and removing barriers that may prevent access by mobile virtual network operators to local wholesale mobile services to offer roaming services.

Limited spectrum and the increasing demand for data services mean that mobile networks will strive to offload traffic to fixed networks. Policy makers and regulators need to ensure enough supply to maintain sufficient backhaul for wireless networks, especially if there is insufficient fixed access network competition. While there is debate as regards the schedule for fibre‐to‐the‐residence, all agree that network operators will continue to bring this technology closer to residences and end users. The challenge for regulators is that, regardless of the technology used, many parts of the OECD look likely to face monopolies or duopolies for fixed networks. Wireless can provide competition, but spectrum availability will always impose limits that are not a constraint for fibre.

Since the 2011 Communications Outlook, the Asia Pacific Network Information Centre has run out of Internet Protocol version 4 (IPv4) addresses under normal procedures, as has Réseaux IP Europeéns Network Coordination Centre. Africa, North America and South America will use up their allocated address space in due time. The successor to IPv4, IPv6, allows 2128 addresses, a near unlimited amount, but has not been implemented to any significant extent. Although over half the equipment deployed on the wired Internet is capable of supporting IPv6 today, less than 1% of this equipment connects to a service that provides IPv6.

While industry levies or fees may be justified for specific purposes, such as funding the sector regulator or contributing to universal service goals, additional tax burdens on the telecommunication sector may harm both consumers and the industry itself.

Liked this article? Share it!