1 May, 2013

OECD Report Warns of Debt Threat to Japan’s Growth Prospects

23/04/2013 – Japan is poised for an economic expansion, but long-term growth prospects remain contingent on additional efforts to revitalise the economy and reduce unsustainable levels of public debt, according to the OECD’s latest Economic Survey of Japan. The new Survey, presented in Tokyo by OECD Secretary-General Angel Gurría, forecasts the Japanese economy will grow by about 1.5% annually in 2013 and 2014. The report hails Prime Minister Shinzo Abe’s three-pronged strategy — bold monetary policy, flexible fiscal policy and a growth strategy — to end 15 years of deflation and relaunch economic growth.

Download the underlying data in Excel format: http://dx.doi.org/10.1787/888932797746 |

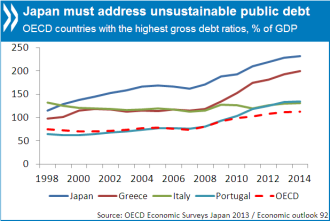

The Survey points out that Japan’s gross public debt reached 220% of GDP in 2012 – the highest level ever recorded in the OECD area – while the budget deficit is hovering around 10% of GDP. With the debt ratio moving further into uncharted territory, the report underlines the urgent need to restore fiscal sustainability. “The sustainability of public finances is a major concern, but I hope that the medium-term fiscal plan that the government has promised to present later this year will help improve the situation,” Mr Gurría said.

The plan should include spending cuts and tax increases large enough to bring the budget back into primary surplus by 2020 and stabilise the public debt ratio. A detailed and credible package is essential to maintain market confidence in Japan’s fiscal situation, mitigating the risk of a run-up in long-term interest rates, the OECD said.

After two severe shocks – the 2008 global financial crisis and the 2011 Great East Japan Earthquake – Japan fell into recession for the third time in five years. The public debt ratio has risen steadily for two decades, to over 200% of GDP. Strong and protracted consolidation is therefore necessary to restore fiscal sustainability, which is Japan’s paramount policy challenge. However, this will slow nominal GDP growth, making fiscal adjustment still more difficult. Hence, exiting deflation and boosting Japan’s growth potential are key to addressing the fiscal predicament.

Remarks by Angel Gurría, OECD Secretary-General, delivered for the launch of the Japan Economic Survey. The Survey covers a range of other topics, including recommendations to:

Use regulatory reform to boost growth. This is particularly necessary in the agriculture sector, where high levels of public support and stringent market access restrictions protect a dwindling number of ageing, uncompetitive farmers. The OECD says Japan can create a more competitive agriculture sector by promoting consolidation of farmland to boost productivity; phasing out supply control measures; and shifting to less distorting forms of government support. A more market-oriented agricultural sector would promote Japan’s integration in the world economy, thus boosting Japan’s growth potential.

Promote green growth and restructure the energy sector. The Fukushima nuclear accident has opened the door to a new energy policy. The reduced role of nuclear power increases the need for other energy sources, including renewables, which currently account for about 11% of electricity generation, or about half the OECD average. Increasing the use of renewables will green the economy and help Japan reduce its greenhouse gas emissions. Japan also has an opportunity to restructure the electricity sector, including the unbundling of generation and transmission and expanding competition in the wholesale and retail markets.

Increase women’s participation in the labour force. To face the challenges posed by the ageing population, Japan needs to make the most of its human resources, particularly women. . This will require, inter alia, reforming the tax and social security system, encouraging better work-life balance, and increasing the availability of affordable childcare.

Stopping and reversing the rise in the debt-to-GDP ratio is crucial. Stabilising the public debt ratio by 2020 may require, depending on the evolution of GDP and interest rates, an improvement of the primary fiscal balance from a deficit of 9% of GDP in 2012 to a surplus as high as 4% by 2020. Controlling expenditures, particularly for social security in the face of rapid population ageing, is key. Substantial tax increases will be needed as well, although this will also have a negative impact on growth. Given the size and duration of fiscal consolidation, Japan faces the risk of a marked rise in interest rates, threatening a banking system that is highly exposed to Japanese government debt.

Ending 15 years of deflation is a priority. The Bank of Japan’s new commitment to a 2% inflation target and “quantitative and qualitative monetary easing” is welcome. The planned doubling of the monetary base, through expanded purchases of government bonds with longer maturities and private assets, is aimed at achieving the inflation target in about two years. Aggressive monetary easing will boost growth and inflation, in part through a weaker yen, although Japan is not targeting the exchange rate.

Reconstruction from the tragic 2011 disaster highlights some of the structural reform challenges facing Japan. Reform of agriculture, an important sector in the Tohoku region, is a priority. The high level and distortionary nature of agriculture support imposes heavy burdens on consumers and taxpayers, undermines the dynamism of the farming sector, complicates Japan’s participation in comprehensive bilateral and regional trade agreements, and entails environmental costs. The reduced role of nuclear power following the Fukushima accident calls for accelerating the development of renewable energy over the long run. This would be facilitated by fundamental reform of the electricity sector to reduce the negative impact of integrated, regional monopolies and the lack of an effective price mechanism.

Boosting labour force participation and productivity are essential. With the working-age population projected to fall by 40% by 2050, measures are needed to make the most of Japan’s human resources, including women, older persons and youth. The tax and social security systems and inadequate childcare facilities create work disincentives for secondary earners, primarily women. For older workers, mandatory retirement at age 60 ends careers prematurely, especially as Japan has the highest life expectancy in the world. Educational reforms are needed to help boost productivity, beginning with more investment in pre-primary education. Japanese universities do not rank high in international comparison in many respects, including in their contribution to innovation.

Fiscal consolidation may adversely affect inequality and poverty. Both have risen in recent years, with Japan’s relative poverty rate now the sixth highest in the OECD. The redistributive powers of the tax and benefit systems are weak in Japan, while the high share of low-paid, non-regular workers contributes to inequality. Labour market dualism is driven in part by higher employment protection for regular workers, encouraging firms to hire non-regular workers to enhance employment flexibility, and by the lower labour cost of non-regular workers. The reliance on private, after-school lessons, particularly in juku, perpetuates inequalities, as their high costs makes participation dependent on family income.

Japan has faced two major shocks since 2008

Recent macroeconomic developments in Japan

Japanese asset prices have been on a downward trend during the past two decades

The Producer Support Estimate for Japan is one of the highest in the OECD

Japan’s farm work force is elderly

The degree of decoupling in Japan is one of the lowest in the OECD

Japan’s electricity price in the industrial sector was one of the highest in the OECD in 2011

Japan’s population, already the oldest in the OECD, is ageing rapidly

The gap between central government expenditure and tax revenue is widening

Public social spending has risen rapidly, driven by pensions and health care

The impact of taxes and transfers on income inequality and poverty is weak in Japan

Liked this article? Share it!