9 Apr, 2013

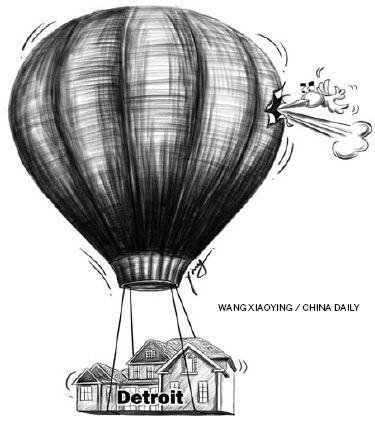

Chinese Warned of Dangers of Investing in US Realty Sector

Some experts attribute Detroit’s decline to its dependence on the automobile industry. But that is not totally true. During the height of the subprime crisis in 2008, when the US’ three main automakers were on the edge of bankruptcy, Detroit managed to struggle through.

Ironically, now that General Motors, Ford and Chrysler are back in the black, Detroit is only a step away from bankruptcy. Chrysler registered a profit in 2011, and the operating revenues and profits of Ford and General Motors remain in double digits, with GM topping global auto sales. The US’ economic recovery, credit easing and the need to change old vehicles for new have pushed overall auto sales by 13 percent and the industry’s year-on-year growth in 2013 is expected to reach 7 percent. So, instead of regaining its strength, why should Detroit be on the verge of bankruptcy?

The real turning point for Detroit was “the largest-scale domestic riot since the Civil War” – in July 23, 1967 – when riots rocked 114 cities in 32 US states and forced Lyndon Johnson, then US president, to send 5,000 troops to control the situation. Forty-three people were killed, thousands were injured and 7,200 arrested. The riots forced middle-class whites to flee the city, causing a sharp drop in the urban white population and increase in the number of black residents. The decline in the service sector, as a result of riots and migration, drew youths to crime and substantially raised the city’s crime rate slowly turning it into a “ghost city” or “crime city”.

Worse, because of the US’ reluctance to admit, and therefore deal with, racial problems, some towns and communities in Detroit with majority black population have lost the capability of solving their socio-economic problems. Some unscrupulous local politicians, and corrupt black elites, have overtly or covertly used the race factor to their advantage, making the problem even more difficult to solve.

The US federal government adopted an emergency management system for local governments in the 1970s when New York City was on the verge of bankruptcy. The same policy could have saved Detroit from collapsing. But the announcement of Michigan’s white governor, Rick Snyder, that an emergency financial manager would virtually take over Detroit, which has been controlled by blacks for more than 40 years, has invited accusations full of racial undertones. The city council has openly called on its people to fight against the “takeover”, claiming that the Michigan state government has violated local citizens’ right to vote.

In other words, Detroit’s decline can be attributed to racial tension.

If that is so, then the choice of Kevyn Orr, a black lawyer with a background in restructuring, as the most capable candidate for the job may not be good one either. And that is precisely the reason why overseas investors should not be rushing in to buy property in Detroit. After all, the city’s socio-economic recovery has not even begun.

Given the lack of employment opportunities, youths are likely to be drawn to crime, which, together with the declining population trend of the past four decades, could push the city toward an even bleaker future. Under such circumstances, is investing in Detroit worth the trouble?

The decline in population is not unique to Detroit, for Buffalo in the US, Leipzig in Germany, and Liverpool and Manchester in the United Kingdom are witnessing a similar trend. Because of falling birth rates and the decline in their pillar industries, small and medium-sized cities and towns in many countries, especially the developed and industrializing ones, are losing their USP.

Many Japanese towns and villages are now home to mainly senior citizens. Kansas, and North and South Dakota have relatively few young and middle-aged people, and some cities in the US are even introducing policies to give land for free to retain working-age people. And in Europe, the drop in birth rate is shrinking the population and threatening the economic balance.

Because of these reasons, when the “one-dollar villas” news first hit the headlines a couple of years ago, I advised Chinese investors through an interview with the Los Angeles Times to be discreet about “bottom fishing” in the US property market. My message was that Chinese investors should not assume, on the basis of the continued rise in housing prices in China, that real estate investment in the US was a lucrative proposition.

Since urbanization in the US was completed decades ago, the urban real estate sector has ceased to be a pillar industry. Since people in the US more than anywhere else are likely to move to the outskirts of cities and villages in search for a better life, the American urban landscape is not likely to favor the realty sector in the long run.

Hopefully, Chinese investors will avoid the trap of investing in real estate in “to-be-ghost cities” in their quest to make profits.

The author is a researcher at the International Trade and Economic Cooperation Institute of the Ministry of Commerce.

Liked this article? Share it!