21 Jan, 2012

Holiday Season Saw More U.S. Retail Sales, But Fewer In-store Shoppers

NEW YORK, Jan. 16, 2012 /PRNewswire/ — Despite continued economic uncertainty, holiday shoppers bought more this year than last, giving retailers two holiday seasons with year-over-year sales increases in a row.

According to ShopperTrak — a provider of retail and mall foot-traffic counting services — national retail sales, when compared to the same period last year, rose 3.5 percent during November and December, while foot traffic decreased 3.1 percent.

“We know stores saw less foot-traffic and increases in sales during the holiday season, indicating consumers were focused and took fewer trips,” said Bill Martin, ShopperTrak founder. “Retailers who tracked their foot-traffic daily better understood and predicted shopper trends and made the most of every opportunity that walked through their doors with appropriate inventory and staffing adjustments.”

Sales results decoded

Throughout the holiday season, ShopperTrak estimates consumers spent $251.4 billion dollars in GAFO retail sales. Sales rose 3.5 percent over 2010, but slightly lower than ShopperTrak’s forecast of a 3.7 percent increase.

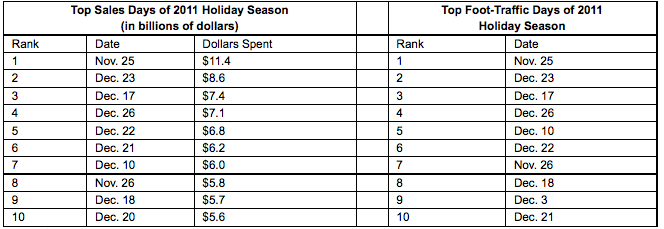

The season started with four straight weeks of year-over-year sales gains in November, with Thanksgiving week having the largest year-over-year sales gain for the month — a 4.4 percent increase over the same period last year and $134.2 billion spent. Sales lagged in early December, as shoppers assessed their budgets after “Black Weekend.” ShopperTrak also attributes December’s slow start to Hanukkah falling later in the month this year than it did in 2010, negatively affecting retail sales early on. Sales surged late in the season, however. The week before Christmas saw the season’s largest year-over-year sales gain of 14.4 percent, $193.7 billion spent and six of the season’s top 10 sales days occurred in the eight days prior to Christmas.

Less shoppers spent more money

While shoppers bought more, they browsed less, according to ShopperTrak. In-store foot-traffic decreased 3.1 percent for the 2011 holiday season over the same period last year. According to ShopperTrak, foot-traffic suffered year-over-year decreases in all but two weeks from Nov. 5 through Jan. 7. Gas prices rose 13 percent over the average fuel prices in the 2010 holiday season, which may account for some foot-traffic loss.

“Our shopper-counts from 25,000 locations in the U.S. indicate shoppers were more targeted in their holiday shopping than in years past,” added Martin. “Many pre-shopped for gifts online and then went to stores with in-stock merchandise priced at the best values to make purchases.”

The only week with a year-over-year gain in shopper traffic during the holiday season was the week ending December 24, as late season shoppers procrastinated or sought out last-minute deals.

ShopperTrak expects the downward trend in foot traffic to continue in 2012. Converting fewer numbers of shoppers to buyers has never been more important for retailers who understand this critical retail health indicator.

“Although foot-traffic declined this holiday season compared to last year, it performed slightly above our expectations,” added Martin. “The season’s foot-traffic results make it clear that focused, convenience-oriented shoppers are here to stay, and retailers who track foot-traffic will be most successful in 2012.”

Apparel and Accessories sector up; Electronics and Appliance sector lags

The historically popular Apparel and Accessories category’s sales increased 6.2 percent while its foot traffic declined 1.1 percent this holiday season compared to 2010. According to ShopperTrak, winter-weather apparel sales may have suffered early in the season as unseasonably warm weather across the nation hurt purchases of coats, boots and other winter basics.

The Electronics and Appliance sector’s sales increased 1.4 percent over last year, and foot traffic decreased slightly by 0.8 percent. The declines are due to few highly anticipated electronic products hitting the shelves this season and many value-conscious shoppers searching online for deeper discounts on these big ticket items. Both Apparel and Accessories and Electronics and Appliances categories performed closely to ShopperTrak forecasts released in September 2011.

“This holiday season, we saw a very resilient American consumer,” said Martin. “Despite the struggling economy, retailers who accurately monitor daily foot-traffic and make appropriate adjustments to assist focused, value-driven buyers will succeed.”

ShopperTrak measures foot-traffic in more than 25,000 stores in the United States and analyzes the data in a proprietary econometric model to create its National Retail Sales Estimate™ (NRSE) of general merchandise, apparel and accessories, furniture and other sales (GAFO). Its estimate precedes the federal government’s official reports by several weeks and since January 2005 it has been accurate to plus or minus 3 percent.

For more information about ShopperTrak’s holiday season recap, visit booth number #2327 at the National Retail Federation’s Big Show taking place Jan. 16-17 at the Javits Center in New York, New York or visit www.shoppertrak.com.

Liked this article? Share it!