10 Oct, 2013

Emerging Asian economies expected to remain resilient, says new OECD Economic Outlook

Brunei Darussalam, 8 October 2013 – The economic outlook for Emerging Asia (Southeast Asia, China and India) remains robust over the medium term, anchored by the steady rise in domestic demand, according to a new report from the OECD Development Centre. GDP growth in Emerging Asia is projected to moderate gradually but stay resilient over the 2014-18 period, with an average annual growth of 6.9%, albeit less than the 8.6% registered before the global financial crisis (2000-07). The region will continue to play an important role in global growth.

The Economic Outlook for Southeast Asia, China and India says Indonesia is projected to be the fastest-growing ASEAN‑6 economy with an average annual growth rate of 6.0% in 2014‑18, followed by the Philippines with 5.8%. Real GDP growth in Malaysia and Thailand is projected to increase by an annual 5.1% and 4.9% respectively, led by domestic demand, especially in infrastructure investment and private consumption. Singapore’s economy is forecast to grow by 3.3%. Cambodia, Lao PDR, Myanmar and Viet Nam are expected to grow at a robust pace over the medium term.

Real GDP growth of Southeast Asia, China and India (annual percentage change)

|

2012 |

2018 |

2014-18 |

2000-07 |

|

| ASEAN-6 countries | ||||

| Brunei |

1.0 |

2.4 |

2.3 |

– |

| Indonesia |

6.2 |

6.1 |

6.0 |

5.1 |

| Malaysia |

5.6 |

5.3 |

5.1 |

5.5 |

| Philippines |

6.8 |

5.9 |

5.8 |

4.9 |

| Singapore |

1.3 |

3.1 |

3.3 |

6.4 |

| Thailand |

6.5 |

5.3 |

4.9 |

5.1 |

| CLMV countries | ||||

| Cambodia |

7.2 |

7.1 |

6.8 |

9.6 |

| Lao PDR |

7.9 |

7.5 |

7.7 |

6.8 |

| Myanmar |

– |

7.0 |

6.8 |

– |

| Viet Nam |

5.2 |

6.0 |

5.4 |

7.6 |

| Average of ASEAN 10 |

5.5(*) |

5.6 |

5.4 |

5.5(**) |

| 2 large economies in Emerging Asia | ||||

| China |

7.8 |

7.5 |

7.7 |

10.5 |

| India |

3.7 |

6.1 |

5.9 |

7.1 |

| Average of Emerging Asia |

6.5 |

6.9 |

6.9 |

8.6 |

Notes: The cut-off date for data is 6 September 2013. *) Exclude Brunei Darussalam and Myanmar. **) Exclude Myanmar. Source: OECD Development Centre, MPF-2014. For more detailed information of, MPF, see www.oecd.org/dev/asiapacific/mpf Emerging Asia includes ASEAN-10 countries, China and India.

“The success of emerging Asian economies will hinge on managing several challenges”, said OECD Deputy Secretary General Rintaro Tamaki. “To harness the medium-term growth potential, it is critical that policy makers implement structural policies to reap the benefits of capital flows and foster closer economic co‑operation and integration in the region.”

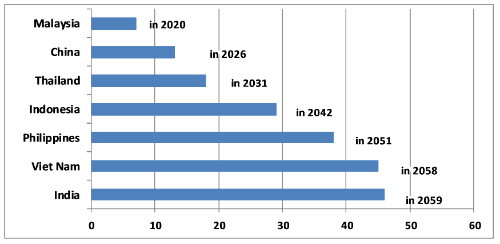

Mario Pezzini, Director of the OECD Development Centre added, “While Emerging Asia has made remarkable economic progress over the past four decades, some of the middle-income developing economies face difficult challenges to sustain their long-term growth and move beyond the middle-income trap. Indeed, success will require fundamental changes in economic structure and further development of the modern services sectors.” In the “best scenario”, if fundamental changes are applied, China and Thailand could become high-income countries within 20 years. On the other hand, Viet Nam and India will need more than 40 years to reach the high-income group.

To grow beyond the middle-income trap, these Emerging Asia countries need to shift away from growth that is driven primarily by factor accumulation. They should rather embrace growth based on productivity increases driven by improvements in the quality of human capital and innovation.

Best scenario simulation of estimated time required to become high income countries for selected Asian middle income countries (years)

Source: OECD Development Centre. Note: Based on World Bank’s criterion for classifying economies, high income countries are defined as having GNI per capita above USD 12 000 in 2013. Growth prospects in this simulation are in line with MPF-2014. Population projections are based on UN data.

The Outlook examines policy insights for China, India, Indonesia, Malaysia, the Philippines, Thailand and Viet Nam that come from the development experiences of other advanced Asian economies such as Japan, Korea and Singapore.

While manufacturing will continue to be important, the middle-income countries of the region should also consider further developing their service sectors, especially in finance, information and communications technology, and business services. According to the OECD Product Market Regulation Indicators (PMR) – widely used as an indicator of the stringency of regulation – China and Indonesia’s services markets are considerably more restricted than those of more advanced Asian economies, notably Japan and Korea, and the most restrictive among the largest developing countries.

The report states that the further development of institutional capacities which help to enhance human capital, foster competition and innovation, and facilitate infrastructure development, also needs to be central to development strategies of the middle-income Emerging Asian countries. On-going efforts to achieve greater regional integration can have a potentially high payoff in helping the middle-income countries in Emerging Asia to reduce the gap with the higher-income countries.

Liked this article? Share it!